Whirlpool Corporation (WHR) cut its dividend due to the impact of a protracted housing downturn, poor results, leverage, tariffs, and trade uncertainty. Weak financial results, lower sales, and earnings for a longer than expected time have taken a toll on the company. The firm’s dividend has been constant since Q1 2022, and it was eventually cut this year.

The share price has fallen dramatically since early May 2021. Investors sold this dividend stock due to concerns about a weak demand from a suppressed housing market, poor top and bottom line results, tariffs, debt, and a potential dividend cut. Depending on housing recovery, tariffs, and future operating and financial results, another reduction may occur.

Affiliate

Stock Rover is an award winning investment research platform.

- The site has 8,500+ stocks, 4,000 ETFs, and 40,000 mutual funds.

- Access to 650+ metrics, financial data, market news, stock and fund ratings, fair value, margin of safety, etc.

- Includes brokerage integration, portfolio tracking, rebalancing, watchlists, alerts, future income forecasts, etc.

Click here to try Stock Rover for free (14-day free trial).

Overview of Whirlpool Corporation

Whirlpool Corporation was founded in 1911 and is headquartered in Benton Harbor, MI. It is a global manufacturer of home appliances specializing in washers, dryers, refrigerators, freezers, cooking appliances, and mixers. The firm operates through four segments: Major Domestic Appliances North America (62% of revenue) Major Domestic Appliances Latin America (62% of revenue), Major Domestic Appliances Asia (11% of revenue), and Small Domestic Appliances Global (6% of revenue). It owns many well-known brands such as Whirlpool, Maytag, Amana, Jenn-Air, KitchenAid, and others.

Total revenue was $16,607 million in 2024 and $15,522 million in the past twelve months.

Dividend Cut Announcement

During the second quarter of 2025, on Monday, July 28th, Whirlpool Inc. (WHR) cut its dividend. The company’s quarterly dividend rate was $1.75 per share before the announcement. The dividend is now $0.90 per common share, a 48.6% reduction. In the announcement on July 28th, the company stated,

“We will be recommending an annual dividend payout rate of $3.60 per share, creating balance sheet capacity, the dividend is approved quarterly by the board of directors.”

Later, in the second quarter earnings call transcript, the CFO stated,

“Lastly, we are committed to returning cash to shareholders by funding a healthy dividend. We are confident our business is well positioned for growth. However, the volatile macro environment and prolonged suppressed housing cycle have impacted our short- term results. After careful consideration with focus on our long-term value creation, we are recommending to adjust the annual dividend rate to $3.60 per share starting in the third quarter. While this decision was not taken lightly, it is critical to ensure we create the capacity on our balance sheet for future investments in the U.S. and continued focus on debt repayment. As a reminder, the dividend is approved quarterly by the Board of Directors.”

Effect of the Change

By cutting the dividend by almost 49%, Whirlpool desired to decrease its quarterly and annual dividend distributions and increase its financial flexibility. The firm is experiencing lower top and bottom lines because of a prolonged housing downturn. Additionally, tariffs, inflation, and broader economic uncertainty have impacted results. Another consideration is that the balance sheet is leveraged with low interest coverage.

The company’s dividend rate has been constant since Q1 2022, so it did not have a streak of increases. The firm was not a dividend growth stock. The result is that less free cash flow (“FCF”) is required for the dividend distribution, allowing the company to preserve liquidity and reduce debt and invest in growth.

Challenges

Whirlpool is facing a challenging business environment because of a weak housing market. Tariffs and trade uncertainties are resulting in higher input costs and affecting profitability. Consumers are also stretched because of inflation and have pulled back on spending. Additionally, the balance sheet is leveraged, and interest coverage has declined.

Housing Cycle

Housing sales have declined considerably, and the industry is in a prolonged downturn. The overall number of sales is near a 25-year low because of high prices outpacing income gains, years of reduced building, and higher interest rates after a period of low rates. Consequently, homes are staying on the market longer, and in some states, prices are declining, particularly in Florida, Texas, and Arizona.

Tariffs and Trade Uncertainty

Tariffs are another major concern for Whirlpool. The company operates manufacturing facilities globally and probably imports products into the United States from other countries. Tariffs are a direct cost to importers and will be passed on to consumers.

Inflation and Consumers

Inflation affects both Whirlpool’s input costs and consumers. Customers are spending less because incomes are not keeping up with inflation. As a result, they may defer home remodeling and appliance purchases.

Debt and Leverage

Whirlpool is a leveraged firm with over $7.25 billion in net debt. It currently has approximately 2.67 times interest coverage and a leverage ratio of about 5.06 times. Moreover, it has a non-investment-grade credit rating of BB+/Ba1, after it was lowered in May 2025. This suggests the credit rating agencies expect weak demand and earnings because of a depressed housing market, tariffs, and debt payments.

Dividend Safety

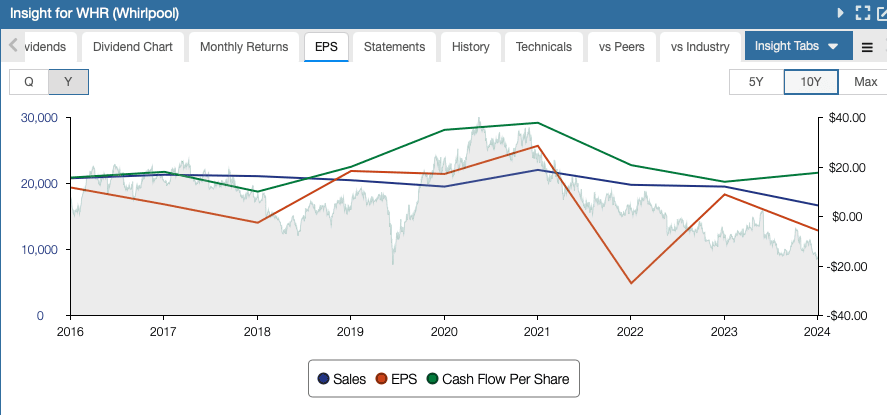

Because of weaker revenue and earnings per share (“EPS”), Whirlpool’s dividend safety metrics were poor. EPS has been negative for four years out of the past ten and three of the last five. They peaked at $28.36 in 2021 and were a loss of ($2.63) in 2024. Consensus estimates indicate $6.42 per share in 2025.

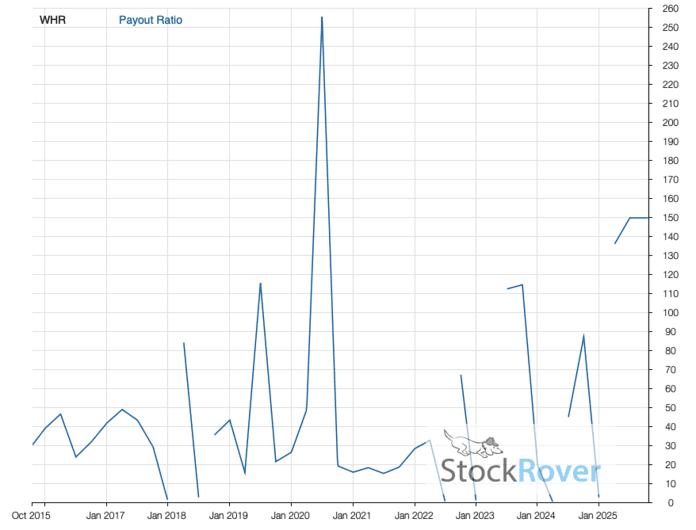

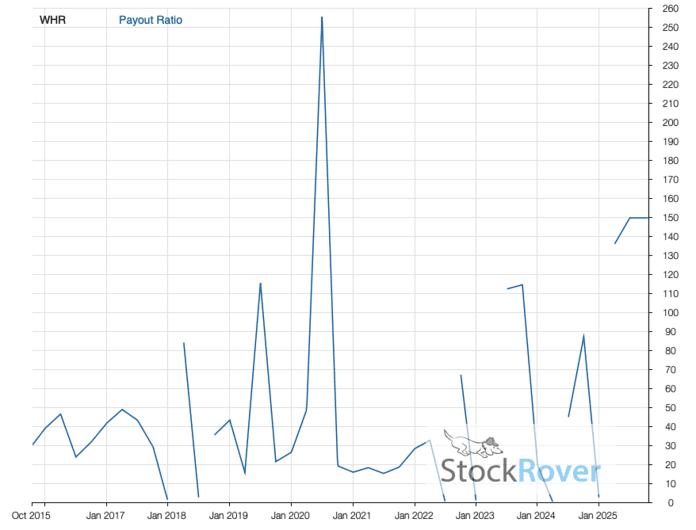

As shown in the chart below from StockRover*, the dividend yield increased rapidly to almost 9.2% in May 2025. Although not yet over the critical threshold of 10%, high values are associated with companies facing operating and financial difficulties. Also, it was much greater than the 4-year average of 5.6%. After reducing the dividend by approximately 49%, the forward dividend yield is now around 4.95%. The quarterly rate is $0.90 per share. However, the yield is still appreciably greater than that of the S&P 500 average.

The annual dividend now requires about $201.6 million ($3.60 yearly dividend x 56 million shares), compared to $384 million in 2024. The lower rate will improve the payout ratio, which was negative in some years and reached over 100% before the cut, indicating that earnings were not covering the dividend. Additionally, FCF had declined to $384 million in 2024 after peaking at $1,651 million in 2021. We expect the yearly difference in cash flow requirements to enhance liquidity and allow Whirlpool to pay down debt, while investing in growth.

Although the dividend is in a better position and more secure now, the firm’s dividend is still not entirely safe, as demonstrated by the weak credit rating. Further decline in demand, a suppressed housing market, persistent inflation, or increased tariffs and trade uncertainty may result in another dividend cut.

Subsequently, we view the equity in jeopardy for another dividend reduction unless the housing market recovers and results improve.

Final Thoughts on Whirlpool (WHR) Dividend Cut

A suppressed housing market for longer than expected has negatively affected sales and profitability. In addition, high interest rates, low housing starts, inflation, and a stressed consumer have contributed to poor results. As a result, lower earnings for a longer-than-anticipated period, leverage, and low interest coverage have caused difficulties for Whirlpool. Tariffs and trade uncertainty have further complicated matters in 2025. The collective effect resulted in declining dividend safety metrics. As a result, Whirlpool cut its dividend. However, we view the company as at risk for another significant decrease.

Related Articles on Dividend Power

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more. It is an excellent resource for DIY dividend growth investors and retirees.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor, analyst, and writer on dividend growth stocks and financial independence. His writings can be found on Seeking Alpha, InvestorPlace, Business Insider, Nasdaq, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial sites. In addition, he is part of the Portfolio Insight and Sure Dividend teams. He was recently in the top 1.0% and 100 (73 out of over 13,450) financial bloggers, as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.