In an uncertain global economic environment like this, many investors are wondering where they can get safe and reliable income. Treasury yields have risen, but treasuries generally offer weak inflation protection.

But when it comes to high-yielding equities, it’s far from guaranteed that they all will be able to maintain their dividends during an economic downturn.

Real estate investment trusts, or REITs, could be a good choice in this environment. Their “real asset” business protects investors against inflation, and tax laws demand that they pay out the majority of their (taxable) income, which is why many REITs offer above-average dividend yields.

In this article, we will showcase three top REITs that have very reliable and safe dividends.

Affiliate

Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more.

Best REITs for Safe Dividend Income

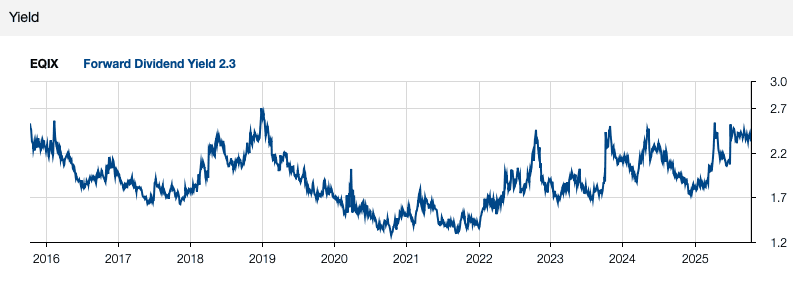

Equinix Inc. (EQIX)

Equinix is a data center REIT that owns 272 data centers across 36 countries on six continents, serving over 10,000 customers. More than half of the data centers are outright owned by Equinix, and these generate 69% of recurring revenues.

EQIX reports revenue in several segments, including colocation, interconnection, managed infrastructure, and others. The Interconnection Solutions segment allows customers to connect directly, securely, and dynamically within and between other EQIX data centers around the globe. There are currently 490,000+ total interconnections.

Customers of EQIX are telecommunications carriers, mobile and network service providers, cloud and IT service providers, digital media and content providers, and financial services companies. In 2024, 94% of total revenue was recurring.

Equinix reported second-quarter 2025 results on July 30th, 2025. For the quarter, the company announced a 4% increase in revenue to $2.256 billion compared to Q2 2024. It has thus achieved 90 consecutive quarters of revenue growth. And its AFFO per share increased 7% compared to the previous year quarter to $9.91.

Equinix continues to expand on its platform and has 59 major projects in development across 34 markets. Management raised its 2025 annual guidance and now expects full-year revenues of $9,233 million to $9,333 million, AFFO of $3,703 million to $3,783 million, and AFFO per share to increase by approximately 9% at the midpoint.

Future growth will come in large part through new property acquisitions. For example, Equinix announced on July 22nd, 2024, that it will expand into the Philippines by acquiring three data centers from Total Information Management for $180 million in cash. The company aims to expand its business and capitalize on the rapidly growing Southeast Asia market.

On October 1st, 2024, Equinix announced it signed a new JV with GIC and CPP Investments to raise more than $15 billion to grow the Equinix xScale data center portfolio. GIC and CPP Investments will own 37.5% of the JV, and Equinix will own 25%. EQIX has increased its dividend for nine consecutive years and is thus a Dividend Challenger.

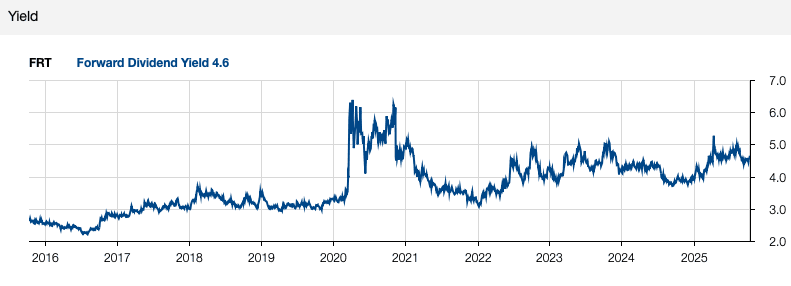

Federal Realty Trust (FRT)

Federal Realty Trust (FRT) is a retail REIT. The company’s footprint is centered on major coastal urban centers, where the high population density results in high demand for retail space.

Federal Realty Trust primarily invests in smaller properties rather than malls, which is beneficial because these properties are more resilient to the e-commerce megatrend. They are rented out to grocers, dollar stores, pharmacies, and similar resilient businesses.

On August 1, 2025, Federal Realty Investment Trust reported results for the second quarter ended June 30, 2025, showing continued growth in operating performance and leasing activity across its retail and mixed-use properties. Funds from operations were $172.5 million, or $1.61 per diluted share, up from $1.59 per share in the second quarter of 2024, reflecting rent growth, higher occupancy, and contributions from redevelopment projects.

Total revenue rose to $301.6 million from $288.9 million a year earlier, driven by contractual rent escalations and strong leasing spreads. Same-property net operating income increased 3.6% year-over-year, with portfolio occupancy improving to 94.5% and comparable retail leasing spreads averaging 9.8% on new and renewal leases.

Federal Realty invested approximately $120 million in redevelopment and mixed-use projects during the quarter, advancing developments in markets such as Northern Virginia and South Florida. Liquidity remained strong at $1.5 billion, supported by cash and revolving credit availability, while net debt to EBITDA was 5.8 times, consistent with long-term targets. Management reaffirmed full-year 2025 guidance for same-property NOI growth between 3.0% and 3.5%.

Federal Realty Trust has shown excellent resilience against economic downturns in the past. This can be explained by the business model, which does not experience major headwinds during economic downturns. Even in bad times, consumers need to visit pharmacies. With long-term contracts in place with its tenants, and with those tenants doing okay even during tough times, Federal Realty Trust has been able to generate very reliable funds from operations in the past. As a result, FRT has increased its dividend for 58 consecutive years, placing it on the exclusive Dividend Kings list.

Related Article About Federal Realty Trust

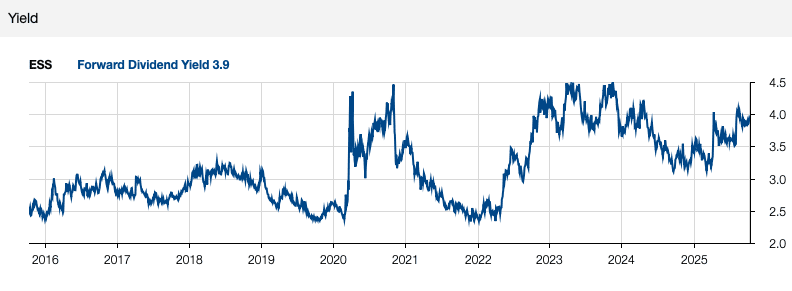

3: Essex Property Trust

Essex primarily owns multifamily residential units, with most of them located in urban centers on the West Coast. Essex Property is one of the largest apartment REITs, owning more than 60,000 units.

On July 30, 2025, Essex reported strong Q2 2025 results, with core FFO per share $0.07 above guidance. Same-store portfolio blended rate growth was 3%, and same-property revenue growth midpoint increased by 15 basis points to 3.15% for the year. Same-property expense midpoint was reduced by 50 basis points to 3.25%, driven by lower property taxes, leading to a 40 basis point improvement in same-property NOI growth.

Full-year core FFO per share guidance rose by $0.10 to $15.91, with Q3 forecasted at $3.94 midpoint. Financially, net debt to EBITDA was 5.5 times, with $1.5 billion in available liquidity. The company issued a $300 million term loan, with $150 million drawn at a 4.1% fixed rate until April 2030, and expanded its line of credit to $1.5 billion, maturing in 2030. Suburban markets like San Mateo (5.6%) and San Jose (4.4%) showed strong blended rate growth, while Los Angeles lagged at 1.3% due to supply and delinquency challenges.

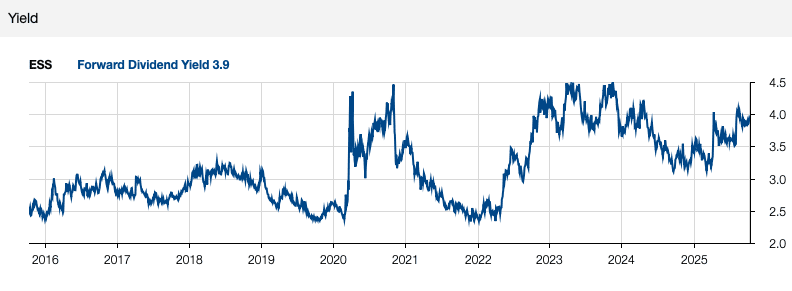

Essex Property has managed to grow its dividend for 31 years in a row, making it a Dividend Aristocrat. This was possible because Essex Property’s business model is resilient. It has delivered reliable FFO growth through organic rent increases at existing properties, with acquisitions and new projects also contributing. We believe that there is a high likelihood that Essex Property will continue to deliver solid growth in the long run.Essex Property currently offers a dividend yield of 3.9%.

Related Article About Essex Property Trust

Disclosure: No positions in any stocks mentioned.

Related Articles on Dividend Power

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more. It is an excellent resource for DIY dividend growth investors and retirees.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

- Portfolio Insight is the newest and most complete portfolio management tool with built-in stock screeners. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Bob Ciura

Bob Ciura is President of Content at Sure Dividend. Bob has worked at Sure Dividend since October 2016. He oversees all content for Sure Dividend and its partner sites. Prior to joining Sure Dividend, Bob was an independent equity analyst. Bob received a bachelor’s degree in Finance from DePaul University, and an MBA with a concentration in Investments from the University of Notre Dame.