This article provides an updated list of the Dividend Champions in 2025, select financial data and analysis. The list and data are updated monthly.

The Dividend Champions 2025 companies on United States stock exchanges have raised their dividend for 25+ consecutive years. This list is a select list of only 132 companies. This number is from nearly 6,000 companies listed on the New York Stock Exchange (NYSE) and NASDAQ in 2025, indicating a success rate of approximately 2.2%.

This list is not one of the best or top Dividend Champions. Instead, it is an informational source to assist in making investment decisions. Lastly, the Dividend Champions list was first created in 2008 by David Fish (deceased in 2018). He originally started the list in the Dividend Investing Resource Center.

Affiliate

Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more.

Market Update for the 2025 Dividend Champions

The Dividend Champions 2025 are currently trading at an elevated valuation of a trailing average price-to-earnings ratio of about 23.14X. This multiple is down from its peak of more than 31X in May 2021.

The current average dividend yield is about 2.77%. The average trailing 10-year dividend growth rate is about 6.62%, and the average past 5-year dividend growth rate is around 6.04%. On average, the payout ratio is approximately 55.73%. The mean market cap is currently $56,124 million.

Currently, the Dividend Champion with the highest yield is Universal Health Realty (UHT), and the one trading with the lowest earnings multiple is RenaissanceRe Insurance (RNR).

The updated, selected financial data and the dividend earnings calendar for each stock in the Dividend Champions list are in the tables below. The most recent dividend increases are also available to search.

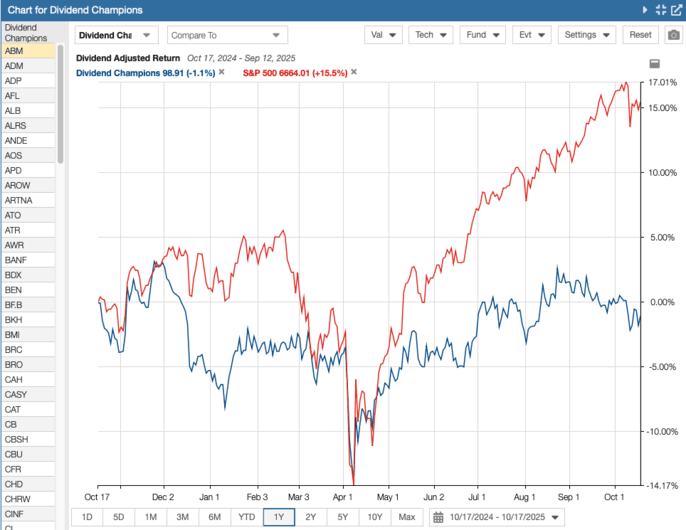

According to Stock Rover*, in the trailing 1-year, the Dividend Champions 2025 have returned -1.1% (blue line) compared to +15.54% for the S&P 500 Index (red line), as seen in the chart below. Over the trailing 5-years, this group of stocks has returned +66.7%, and the S&P 500 has returned +105.4%.

List of Dividend Champions in 2025

Stock Rover* and Portfolio Insight* were used to create this table. Sign up to either one to gain access to data, charts, and screeners.

| Ticker | Company Name | No. Years | Dividend Yield (%) | 10-yr Dividend Growth Rate (%) | Payout Ratio (%) | TTM P/E Ratio | Market Cap (millions) |

|---|---|---|---|---|---|---|---|

| ABM | ABM Indus | 57 | 2.40 | 5.20 | 54.80 | 24.3 | $2,759 |

| ADM | Archer-Daniels-Midland | 51 | 3.20 | 6.20 | 87.80 | 27.6 | $30,427 |

| ADP | Automatic Data Processing | 50 | 2.20 | 12.10 | 60.10 | 28.2 | $113,939 |

| AFL | Aflac | 43 | 2.20 | 11.50 | 48.40 | 24.3 | $57,606 |

| ALB | Albemarle | 29 | 1.80 | 3.40 | n/a | n/a | $10,913 |

| ALRS | Alerus Financial | 19 | 3.90 | 6.70 | 53.60 | 14 | $533 |

| ANDE | Andersons | 29 | 1.60 | 3.40 | 32.70 | 20.2 | $1,624 |

| AOS | A.O. Smith | 31 | 2.00 | 13.60 | 37.10 | 19.4 | $9,768 |

| APD | Air Products | 43 | 2.80 | 8.30 | 102.00 | 36 | $56,350 |

| AROW | Arrow Finl | 28 | 4.40 | 4.10 | 60.70 | 14.3 | $430 |

| ARTNA | Artesian Resources | 30 | 3.70 | 3.50 | 55.60 | 15.5 | $349 |

| ATO | Atmos Energy | 41 | 2.00 | 8.40 | 46.80 | 24.4 | $28,317 |

| ATR | AptarGroup | 31 | 1.50 | 4.90 | 30.50 | 22.3 | $8,520 |

| AWR | American States Water | 70 | 2.70 | 8.40 | 57.10 | 23.2 | $2,906 |

| BANF | BancFirst | 31 | 1.70 | 10.50 | 26.10 | 16.1 | $3,763 |

| BDX | Becton Dickinson | 53 | 2.20 | 5.70 | 74.10 | 34.6 | $54,201 |

| BEN | Franklin Resources | 45 | 5.80 | 7.90 | 249.00 | 43.7 | $11,567 |

| BF.B | Brown-Forman | 41 | 3.20 | 6.00 | 50.10 | 16.1 | $13,534 |

| BKH | Black Hills | 55 | 4.30 | 5.30 | 67.00 | 15.9 | $4,596 |

| BMI | Badger Meter | 32 | 0.80 | 14.90 | 29.40 | 39.2 | $5,302 |

| BRC | Brady | 39 | 1.30 | 1.90 | 24.20 | 19.2 | $3,552 |

| BRO | Brown & Brown | 31 | 0.70 | 10.60 | 16.60 | 25.3 | $28,996 |

| CAH | Cardinal Health | 38 | 1.30 | 2.80 | 31.30 | 24.3 | $37,160 |

| CASY | Casey's General Stores | 25 | 0.40 | 10.00 | 13.20 | 36.4 | $21,083 |

| CAT | Caterpillar | 31 | 1.20 | 7.00 | 28.60 | 26.8 | $246,218 |

| CB | Chubb | 32 | 1.50 | 3.80 | 16.20 | 11.9 | $106,932 |

| CBSH | Commerce Bancshares | 56 | 2.10 | 7.10 | 26.00 | 13 | $7,152 |

| CBU | Community Financial Sys | 32 | 3.40 | 4.20 | 50.00 | 15.2 | $2,940 |

| CFR | Cullen/Frost Bankers | 31 | 3.30 | 6.60 | 41.40 | 13.2 | $7,879 |

| CHD | Church & Dwight Co | 29 | 1.30 | 5.80 | 54.10 | 41.7 | $21,554 |

| CHRW | C.H. Robinson Worldwide | 25 | 2.00 | 5.00 | 55.90 | 29 | $15,043 |

| CINF | Cincinnati Financial | 64 | 2.30 | 6.60 | 28.90 | 13.3 | $23,928 |

| CL | Colgate-Palmolive | 64 | 2.60 | 3.20 | 56.40 | 22.2 | $63,946 |

| CLX | Clorox | 47 | 4.10 | 4.90 | 74.40 | 18.4 | $14,578 |

| CNI | Canadian National Railway | 30 | 2.70 | 11.00 | 66.50 | 18.6 | $60,989 |

| CSL | Carlisle Companies | 48 | 1.40 | 13.90 | 21.90 | 18.2 | $13,845 |

| CTAS | Cintas | 42 | 1.00 | 21.20 | 35.50 | 41.8 | $75,794 |

| CTBI | Community Trust Bancorp | 44 | 4.10 | 5.50 | 37.00 | 10.1 | $944 |

| CVX | Chevron | 38 | 4.50 | 4.80 | 85.60 | 19.7 | $308,429 |

| CWT | California Water Servs Gr | 58 | 2.50 | 6.00 | 50.70 | 21.3 | $2,892 |

| DCI | Donaldson | 29 | 1.50 | 5.80 | 35.90 | 27.2 | $9,587 |

| DOV | Dover | 69 | 1.30 | 2.20 | 12.40 | 21.5 | $22,832 |

| ECL | Ecolab | 33 | 0.90 | 7.00 | 33.50 | 37 | $78,493 |

| ED | Consolidated Edison | 51 | 3.40 | 2.70 | 60.90 | 18.4 | $36,494 |

| EMR | Emerson Electric | 68 | 1.60 | 1.20 | 45.10 | 33.2 | $72,758 |

| ENB | Enbridge | 30 | 5.80 | 7.30 | 182.00 | 23.3 | $102,988 |

| EPD | Enterprise Prods Partners | 27 | 7.20 | 3.70 | 79.40 | 11.3 | $65,368 |

| ERIE | Erie Indemnity | 35 | 1.70 | 7.20 | 39.30 | 26.5 | $16,558 |

| ES | Eversource Energy | 27 | 4.20 | 6.10 | 128.20 | 31.7 | $26,928 |

| ESS | Essex Property Trust | 31 | 4.00 | 6.00 | 80.60 | 20.9 | $16,720 |

| EXPD | Expeditors International | 29 | 1.30 | 7.90 | 24.40 | 19.6 | $16,275 |

| FAST | Fastenal | 27 | 2.10 | 12.10 | 79.80 | 39.8 | $48,745 |

| FDS | FactSet Research Systems | 25 | 1.50 | 9.60 | 30.10 | 18.5 | $10,838 |

| FELE | Franklin Electric | 33 | 1.10 | 10.50 | 26.30 | 25.2 | $4,328 |

| FRT | Federal Realty Investment | 57 | 4.60 | 1.90 | 111.40 | 25.1 | $8,535 |

| FUL | H.B. Fuller | 56 | 1.60 | 6.10 | 43.60 | 28.3 | $3,180 |

| GD | General Dynamics | 34 | 1.80 | 8.10 | 38.80 | 22.2 | $89,077 |

| GGG | Graco | 28 | 1.30 | 10.60 | 36.80 | 29.2 | $13,591 |

| GPC | Genuine Parts | 69 | 3.10 | 5.30 | 69.90 | 22.9 | $18,513 |

| GWW | W.W. Grainger | 52 | 1.00 | 6.80 | 21.30 | 24.2 | $45,679 |

| HRL | Hormel Foods | 59 | 4.80 | 8.80 | 84.10 | 17.5 | $13,216 |

| HTO | H2O America | 57 | 3.30 | 8.00 | 53.40 | 16.4 | $1,772 |

| IBM | IBM | 30 | 2.40 | 2.60 | 106.40 | 45.5 | $262,017 |

| ITW | Illinois Tool Works | 61 | 2.60 | 11.30 | 52.50 | 21.9 | $72,659 |

| JKHY | Jack Henry & Associates | 35 | 1.50 | 8.80 | 36.20 | 24.5 | $11,112 |

| JNJ | Johnson & Johnson | 63 | 2.70 | 5.70 | 53.40 | 18.7 | $465,339 |

| KMB | Kimberly-Clark | 53 | 4.20 | 3.70 | 68.00 | 16.6 | $40,291 |

| KO | Coca-Cola | 63 | 3.00 | 4.40 | 70.30 | 24.3 | $294,543 |

| LECO | Lincoln Electric Holdings | 29 | 1.30 | 10.00 | 33.00 | 26.4 | $12,969 |

| LIN | Linde | 32 | 1.30 | 7.70 | 40.80 | 32.1 | $211,426 |

| LOW | Lowe's Companies | 61 | 2.00 | 15.70 | 38.10 | 20.1 | $137,233 |

| MATW | Matthews International | 32 | 4.30 | 6.80 | n/a | n/a | $712 |

| MCD | McDonald's | 48 | 2.30 | 7.60 | 59.50 | 26.4 | $219,854 |

| MDT | Medtronic | 47 | 3.00 | 6.50 | 77.40 | 26.5 | $122,855 |

| MGEE | MGE Energy | 49 | 2.30 | 4.90 | 50.00 | 23.4 | $3,080 |

| MGRC | McGrath RentCorp | 33 | 1.60 | 6.90 | 18.60 | 11.6 | $2,939 |

| MKC | McCormick & Co | 39 | 2.70 | 8.40 | 60.80 | 23.5 | $18,140 |

| MO | Altria Group | 55 | 6.50 | 6.50 | 78.90 | 12.6 | $109,276 |

| MSA | MSA Safety | 54 | 1.30 | 5.20 | 29.30 | 23.5 | $6,461 |

| MZTI | The Marzetti | 62 | 2.30 | 7.50 | 61.70 | 27.7 | $4,634 |

| NDSN | Nordson | 61 | 1.40 | 13.10 | 39.10 | 29.3 | $13,110 |

| NEE | NextEra Energy | 31 | 2.70 | 11.40 | 75.40 | 29.4 | $174,072 |

| NFG | National Fuel Gas | 54 | 2.50 | 3.10 | 76.80 | 31.8 | $7,744 |

| NJR | New Jersey Resources | 28 | 4.10 | 7.10 | 43.70 | 11.4 | $4,688 |

| NNN | NNN REIT | 35 | 5.60 | 3.30 | 110.00 | 20.4 | $8,072 |

| NUE | Nucor | 52 | 1.70 | 4.00 | 39.30 | 23.6 | $30,248 |

| NWFL | Norwood Financial | 25 | 5.10 | 4.10 | n/a | n/a | $225 |

| NWN | Northwest Natural Hldg | 69 | 4.30 | 0.50 | 77.10 | 18.1 | $1,881 |

| O | Realty Income | 28 | 5.40 | 3.50 | 309.40 | 58.1 | $54,803 |

| ORI | Old Republic Intl | 44 | 2.80 | 4.60 | 30.80 | 11.8 | $10,309 |

| OZK | Bank OZK | 31 | 3.90 | 12.00 | 26.90 | 7.5 | $5,176 |

| PB | Prosperity Bancshares | 21 | 3.70 | 7.80 | 41.80 | 11.5 | $6,000 |

| PEP | PepsiCo | 53 | 3.70 | 7.30 | 105.40 | 29.2 | $210,173 |

| PG | Procter & Gamble | 69 | 2.80 | 4.80 | 61.10 | 23.3 | $354,349 |

| PH | Parker Hannifin | 68 | 1.00 | 11.10 | 24.30 | 27 | $92,831 |

| PII | Polaris | 30 | 4.00 | 2.40 | n/a | n/a | $3,740 |

| PPG | PPG Indus | 53 | 2.80 | 7.00 | 61.30 | 18.4 | $22,924 |

| RBCAA | Republic Bancorp | 24 | 2.50 | 8.60 | 26.80 | 11.2 | $1,386 |

| RGCO | RGC Resources | 50 | 3.90 | 4.90 | 61.70 | 16.2 | $223 |

| RLI | RLI | 29 | 1.10 | 5.40 | 17.10 | 17 | $5,475 |

| RNR | RenaissanceRe Holdings | 32 | 0.60 | 2.90 | 4.00 | 6.4 | $11,811 |

| ROP | Roper Technologies | 51 | 0.70 | 12.70 | 22.00 | 35.5 | $54,293 |

| RPM | RPM International | 30 | 1.90 | 7.00 | 37.90 | 21 | $14,315 |

| RTX | RTX | 30 | 1.70 | 0.60 | 56.00 | 34.7 | $211,422 |

| SBSI | Southside Bancshares | 57 | 5.30 | 5.40 | 50.90 | 9.7 | $816 |

| SCL | Stepan | 34 | 3.40 | 7.90 | 60.20 | 18 | $1,031 |

| SEIC | SEI Investments | 47 | 1.20 | 7.40 | 18.10 | 15.2 | $9,987 |

| SHW | Sherwin-Williams | 28 | 1.00 | 13.50 | 29.50 | 32.8 | $82,464 |

| SJM | JM Smucker | 57 | 4.20 | 5.10 | n/a | n/a | $11,233 |

| SON | Sonoco Prods | 49 | 5.30 | 4.20 | 37.30 | 42.6 | $3,948 |

| SPGI | S&P Global | 52 | 0.80 | 11.30 | 28.70 | 36.4 | $144,464 |

| SRCE | 1st Source | 37 | 2.60 | 8.80 | 25.60 | 10.2 | $1,422 |

| SWK | Stanley Black & Decker | 57 | 4.90 | 4.20 | 103.50 | 21.5 | $10,502 |

| SYK | Stryker | 31 | 0.90 | 9.30 | 43.40 | 49.5 | $143,143 |

| SYY | Sysco | 53 | 2.70 | 6.10 | 55.40 | 21.4 | $38,237 |

| TGT | Target | 56 | 5.00 | 7.40 | 52.10 | 10.6 | $41,277 |

| TMP | Tompkins Finl | 38 | 3.90 | 4.00 | 44.30 | 11.4 | $914 |

| TNC | Tennant | 54 | 1.50 | 4.00 | 35.70 | 24.8 | $1,469 |

| TR | Tootsie Roll Industries | 58 | 0.80 | 3.00 | 28.50 | 35 | $2,071 |

| TROW | T. Rowe Price Group | 39 | 4.90 | 9.30 | 56.00 | 11.6 | $22,784 |

| UBSI | United Bankshares | 50 | 4.20 | 1.50 | 52.10 | 12.4 | $4,990 |

| UGI | UGI | 36 | 4.60 | 5.10 | 78.50 | 17.2 | $6,965 |

| UHT | Universal Health Realty | 40 | 8.20 | 1.50 | 227.90 | 27.9 | $500 |

| UMBF | UMB Financial | 33 | 1.50 | 5.50 | 17.90 | 12.3 | $8,264 |

| UVV | Universal | 54 | 6.10 | 4.70 | 58.70 | 13.1 | $1,335 |

| WABC | Westamerica Bancorp | 30 | 3.90 | 1.90 | 37.10 | 10.2 | $1,171 |

| WLY | John Wiley & Sons | 31 | 3.80 | 1.70 | 78.00 | 20.8 | $1,989 |

| WMT | Walmart | 52 | 0.90 | 3.70 | 33.20 | 40.7 | $858,915 |

| WST | West Pharmaceutical Servs | 32 | 0.30 | 6.70 | 12.40 | 40.5 | $19,458 |

| WTRG | Essential Utilities | 33 | 3.30 | 6.80 | 55.90 | 17.7 | $11,569 |

| XOM | Exxon Mobil | 42 | 3.50 | 3.10 | 55.70 | 16 | $478,506 |

| YORW | York Water | 28 | 2.80 | 3.90 | 63.40 | 22.7 | $452 |

Dividend Calendar for the Dividend Champions 2025

Stock Rover* and Portfolio Insight* were used to create this table. Sign up to track your dividends and income.

| Ticker | Company | Ex-Dividend Date | Dividend Record Date | Dividend Payment Date | Dividend Frequency | Next Dividend Payment Per Share | Forward Dividend Per Share | Fwd. Yield | TTM Yield |

|---|---|---|---|---|---|---|---|---|---|

| ABM | ABM Indus | 10/2/25 | 10/2/25 | 11/3/25 | 4 | $0.26 | $1.06 | 2.40% | 2.40% |

| ADM | Archer-Daniels-Midland | 8/20/25 | 8/20/25 | 9/10/25 | 4 | $0.51 | $2.04 | 3.20% | 3.20% |

| ADP | Automatic Data Processing | 9/12/25 | 9/12/25 | 10/1/25 | 4 | $1.54 | $6.16 | 2.20% | 2.20% |

| AFL | Aflac | 8/20/25 | 8/20/25 | 9/2/25 | 4 | $0.58 | $2.32 | 2.20% | 2.10% |

| ALB | Albemarle | 9/12/25 | 9/12/25 | 10/1/25 | 4 | $0.41 | $1.62 | 1.80% | 1.80% |

| ALRS | Alerus Financial | 9/26/25 | 9/26/25 | 10/10/25 | 4 | $0.21 | $0.82 | 3.90% | 3.90% |

| ANDE | Andersons | 10/1/25 | 10/1/25 | 10/22/25 | 4 | $0.19 | $0.78 | 1.60% | 1.60% |

| AOS | A.O. Smith | 10/31/25 | 10/31/25 | 11/17/25 | 4 | $0.36 | $1.38 | 2.00% | 2.00% |

| APD | Air Products | 10/1/25 | 10/1/25 | 11/10/25 | 4 | $1.79 | $7.16 | 2.80% | 2.80% |

| AROW | Arrow Finl | 8/11/25 | 8/11/25 | 8/25/25 | 4 | $0.29 | $1.16 | 4.40% | 4.30% |

| ARTNA | Artesian Resources | 8/15/25 | 8/15/25 | 8/25/25 | 4 | $0.31 | $1.23 | 3.70% | 3.60% |

| ATO | Atmos Energy | 8/25/25 | 8/25/25 | 9/8/25 | 4 | $0.87 | $3.48 | 2.00% | 2.00% |

| ATR | AptarGroup | 10/23/25 | 10/23/25 | 11/13/25 | 4 | $0.48 | $1.92 | 1.50% | 1.40% |

| AWR | American States Water | 8/15/25 | 8/15/25 | 9/3/25 | 4 | $0.50 | $2.02 | 2.70% | 2.50% |

| BANF | BancFirst | 9/30/25 | 9/30/25 | 10/15/25 | 4 | $0.49 | $1.96 | 1.70% | 1.70% |

| BDX | Becton Dickinson | 9/8/25 | 9/8/25 | 9/30/25 | 4 | $1.04 | $4.16 | 2.20% | 2.20% |

| BEN | Franklin Resources | 9/30/25 | 9/30/25 | 10/10/25 | 4 | $0.32 | $1.28 | 5.80% | 5.80% |

| BF.B | Brown-Forman | 9/3/25 | 9/3/25 | 10/1/25 | 4 | $0.23 | $0.91 | 3.20% | 3.20% |

| BKH | Black Hills | 8/18/25 | 8/18/25 | 9/2/25 | 4 | $0.68 | $2.70 | 4.30% | 4.20% |

| BMI | Badger Meter | 8/22/25 | 8/22/25 | 9/5/25 | 4 | $0.40 | $1.42 | 0.80% | 0.80% |

| BRC | Brady | 10/10/25 | 10/10/25 | 10/31/25 | 4 | $0.25 | $0.98 | 1.30% | 1.30% |

| BRO | Brown & Brown | 8/13/25 | 8/13/25 | 8/20/25 | 4 | $0.15 | $0.60 | 0.70% | 0.70% |

| CAH | Cardinal Health | 10/1/25 | 10/1/25 | 10/15/25 | 4 | $0.51 | $2.04 | 1.30% | 1.30% |

| CASY | Casey's General Stores | 10/31/25 | 11/1/25 | 11/14/25 | 4 | $0.57 | $2.28 | 0.40% | 0.40% |

| CAT | Caterpillar | 10/20/25 | 10/20/25 | 11/20/25 | 4 | $1.51 | $6.04 | 1.20% | 1.10% |

| CB | Chubb | 9/12/25 | 9/12/25 | 10/3/25 | 4 | $0.97 | $3.88 | 1.50% | 1.40% |

| CBSH | Commerce Bancshares | 9/5/25 | 9/5/25 | 9/23/25 | 4 | $0.28 | $1.10 | 2.10% | 2.00% |

| CBU | Community Financial Sys | 12/12/25 | 12/12/25 | 1/12/26 | 4 | $0.47 | $1.88 | 3.40% | 3.30% |

| CFR | Cullen/Frost Bankers | 8/29/25 | 8/29/25 | 9/15/25 | 4 | $1.00 | $4.00 | 3.30% | 3.20% |

| CHD | Church & Dwight Co | 8/15/25 | 8/15/25 | 9/2/25 | 4 | $0.29 | $1.18 | 1.30% | 1.30% |

| CHRW | C.H. Robinson Worldwide | 9/5/25 | 9/5/25 | 10/2/25 | 4 | $0.62 | $2.48 | 2.00% | 2.00% |

| CINF | Cincinnati Financial | 9/22/25 | 9/22/25 | 10/15/25 | 4 | $0.87 | $3.48 | 2.30% | 2.20% |

| CL | Colgate-Palmolive | 10/17/25 | 10/17/25 | 11/14/25 | 4 | $0.52 | $2.08 | 2.60% | 2.60% |

| CLX | Clorox | 10/22/25 | 10/22/25 | 11/6/25 | 4 | $1.24 | $4.96 | 4.10% | 4.10% |

| CNI | Canadian National Railway | 9/8/25 | 9/8/25 | 9/29/25 | 4 | $0.64 | $2.55 | 2.70% | 2.60% |

| CSL | Carlisle Companies | 8/19/25 | 8/19/25 | 9/2/25 | 4 | $1.10 | $4.40 | 1.40% | 1.30% |

| CTAS | Cintas | 8/15/25 | 8/15/25 | 9/15/25 | 4 | $0.45 | $1.80 | 1.00% | 0.90% |

| CTBI | Community Trust Bancorp | 9/15/25 | 9/15/25 | 10/1/25 | 4 | $0.53 | $2.12 | 4.10% | 3.70% |

| CVX | Chevron | 8/19/25 | 8/19/25 | 9/10/25 | 4 | $1.71 | $6.84 | 4.50% | 4.40% |

| CWT | California Water Servs Gr | 8/11/25 | 8/11/25 | 8/22/25 | 4 | $0.30 | $1.20 | 2.50% | 2.40% |

| DCI | Donaldson | 8/12/25 | 8/12/25 | 8/27/25 | 4 | $0.30 | $1.20 | 1.50% | 1.40% |

| DOV | Dover | 8/29/25 | 8/29/25 | 9/15/25 | 4 | $0.52 | $2.08 | 1.30% | 1.20% |

| ECL | Ecolab | 9/16/25 | 9/16/25 | 10/15/25 | 4 | $0.65 | $2.60 | 0.90% | 0.90% |

| ED | Consolidated Edison | 11/19/25 | 11/19/25 | 12/15/25 | 4 | $0.85 | $3.40 | 3.40% | 3.30% |

| EMR | Emerson Electric | 8/15/25 | 8/15/25 | 9/10/25 | 4 | $0.53 | $2.11 | 1.60% | 1.60% |

| ENB | Enbridge | 8/15/25 | 8/15/25 | 9/1/25 | 4 | $0.68 | $2.74 | 5.80% | 5.70% |

| EPD | Enterprise Prods Partners | 10/31/25 | 10/31/25 | 11/14/25 | 4 | $0.55 | $2.18 | 7.20% | 7.10% |

| ERIE | Erie Indemnity | 10/6/25 | 10/6/25 | 10/21/25 | 4 | $1.37 | $5.46 | 1.70% | 1.70% |

| ES | Eversource Energy | 9/22/25 | 9/22/25 | 9/30/25 | 4 | $0.75 | $3.01 | 4.20% | 4.10% |

| ESS | Essex Property Trust | 9/30/25 | 9/30/25 | 10/15/25 | 4 | $2.57 | $10.28 | 4.00% | 3.90% |

| EXPD | Expeditors International | 6/2/25 | 6/2/25 | 6/16/25 | 2 | $0.77 | $1.54 | 1.30% | 1.30% |

| FAST | Fastenal | 10/28/25 | 10/28/25 | 11/25/25 | 4 | $0.22 | $0.88 | 2.10% | 2.00% |

| FDS | FactSet Research Systems | 8/29/25 | 8/29/25 | 9/18/25 | 4 | $1.10 | $4.40 | 1.50% | 1.50% |

| FELE | Franklin Electric | 8/7/25 | 8/7/25 | 8/21/25 | 4 | $0.26 | $1.06 | 1.10% | 1.10% |

| FRT | Federal Realty Investment | 10/1/25 | 10/1/25 | 10/15/25 | 4 | $1.13 | $4.52 | 4.60% | 4.50% |

| FUL | H.B. Fuller | 10/16/25 | 10/16/25 | 10/30/25 | 4 | $0.23 | $0.94 | 1.60% | 1.60% |

| GD | General Dynamics | 10/10/25 | 10/10/25 | 11/14/25 | 4 | $1.50 | $6.00 | 1.80% | 1.80% |

| GGG | Graco | 10/20/25 | 10/20/25 | 11/5/25 | 4 | $0.28 | $1.10 | 1.30% | 1.30% |

| GPC | Genuine Parts | 9/5/25 | 9/5/25 | 10/2/25 | 4 | $1.03 | $4.12 | 3.10% | 3.10% |

| GWW | W.W. Grainger | 8/11/25 | 8/11/25 | 9/1/25 | 4 | $2.26 | $9.04 | 1.00% | 0.90% |

| HRL | Hormel Foods | 10/14/25 | 10/14/25 | 11/17/25 | 4 | $0.29 | $1.16 | 4.80% | 4.80% |

| HTO | H2O America | 8/11/25 | 8/11/25 | 9/2/25 | 4 | $0.42 | $1.68 | 3.30% | 3.30% |

| IBM | IBM | 8/8/25 | 8/8/25 | 9/10/25 | 4 | $1.68 | $6.72 | 2.40% | 2.40% |

| ITW | Illinois Tool Works | 9/30/25 | 9/30/25 | 10/10/25 | 4 | $1.61 | $6.44 | 2.60% | 2.50% |

| JKHY | Jack Henry & Associates | 9/5/25 | 9/5/25 | 9/26/25 | 4 | $0.58 | $2.32 | 1.50% | 1.50% |

| JNJ | Johnson & Johnson | 11/25/25 | 11/25/25 | 12/9/25 | 4 | $1.30 | $5.20 | 2.70% | 2.60% |

| KMB | Kimberly-Clark | 9/5/25 | 9/5/25 | 10/2/25 | 4 | $1.26 | $5.04 | 4.20% | 4.10% |

| KO | Coca-Cola | 9/15/25 | 9/15/25 | 10/1/25 | 4 | $0.51 | $2.04 | 3.00% | 2.90% |

| LECO | Lincoln Electric Holdings | 12/31/25 | 12/31/25 | 1/15/26 | 4 | $0.79 | $3.16 | 1.30% | 1.30% |

| LIN | Linde | 9/4/25 | 9/4/25 | 9/18/25 | 4 | $1.50 | $6.00 | 1.30% | 1.30% |

| LOW | Lowe's Companies | 10/22/25 | 10/22/25 | 11/5/25 | 4 | $1.20 | $4.80 | 2.00% | 1.90% |

| MATW | Matthews International | 8/11/25 | 8/11/25 | 8/25/25 | 4 | $0.25 | $1.00 | 4.30% | 4.30% |

| MCD | McDonald's | 9/2/25 | 9/2/25 | 9/16/25 | 4 | $1.77 | $7.08 | 2.30% | 2.30% |

| MDT | Medtronic | 9/26/25 | 9/26/25 | 10/17/25 | 4 | $0.71 | $2.84 | 3.00% | 2.90% |

| MGEE | MGE Energy | 8/29/25 | 9/1/25 | 9/15/25 | 4 | $0.47 | $1.90 | 2.30% | 2.20% |

| MGRC | McGrath RentCorp | 10/17/25 | 10/17/25 | 10/31/25 | 4 | $0.49 | $1.94 | 1.60% | 1.60% |

| MKC | McCormick & Co | 10/14/25 | 10/14/25 | 10/27/25 | 4 | $0.45 | $1.80 | 2.70% | 2.70% |

| MO | Altria Group | 9/15/25 | 9/15/25 | 10/10/25 | 4 | $1.06 | $4.24 | 6.50% | 6.30% |

| MSA | MSA Safety | 8/15/25 | 8/15/25 | 9/10/25 | 4 | $0.53 | $2.12 | 1.30% | 1.30% |

| MZTI | The Marzetti | 9/8/25 | 9/8/25 | 9/30/25 | 4 | $0.95 | $3.80 | 2.30% | 2.30% |

| NDSN | Nordson | 9/11/25 | 9/11/25 | 9/25/25 | 4 | $0.82 | $3.28 | 1.40% | 1.40% |

| NEE | NextEra Energy | 8/28/25 | 8/28/25 | 9/15/25 | 4 | $0.57 | $2.27 | 2.70% | 2.60% |

| NFG | National Fuel Gas | 9/30/25 | 9/30/25 | 10/15/25 | 4 | $0.54 | $2.14 | 2.50% | 2.50% |

| NJR | New Jersey Resources | 9/22/25 | 9/22/25 | 10/1/25 | 4 | $0.47 | $1.90 | 4.10% | 3.90% |

| NNN | NNN REIT | 10/31/25 | 10/31/25 | 11/14/25 | 4 | $0.60 | $2.40 | 5.60% | 5.50% |

| NUE | Nucor | 9/30/25 | 9/30/25 | 11/10/25 | 4 | $0.55 | $2.20 | 1.70% | 1.70% |

| NWFL | Norwood Financial | 10/15/25 | 10/15/25 | 11/3/25 | 4 | $0.31 | $1.24 | 5.10% | 5.10% |

| NWN | Northwest Natural Hldg | 10/31/25 | 10/31/25 | 11/14/25 | 4 | $0.49 | $1.97 | 4.30% | 4.30% |

| O | Realty Income | 10/31/25 | 10/31/25 | 11/14/25 | 12 | $0.27 | $3.23 | 5.40% | 5.40% |

| ORI | Old Republic Intl | 9/5/25 | 9/5/25 | 9/15/25 | 4 | $0.29 | $1.16 | 2.80% | 2.70% |

| OZK | Bank OZK | 10/14/25 | 10/14/25 | 10/21/25 | 4 | $0.45 | $1.80 | 3.90% | 3.80% |

| PB | Prosperity Bancshares | 9/15/25 | 9/15/25 | 10/1/25 | 4 | $0.58 | $2.32 | 3.70% | 3.70% |

| PEP | PepsiCo | 9/5/25 | 9/5/25 | 9/30/25 | 4 | $1.42 | $5.69 | 3.70% | 3.60% |

| PG | Procter & Gamble | 10/24/25 | 10/24/25 | 11/17/25 | 4 | $1.06 | $4.23 | 2.80% | 2.70% |

| PH | Parker Hannifin | 9/2/25 | 9/2/25 | 9/12/25 | 4 | $1.80 | $7.20 | 1.00% | 0.90% |

| PII | Polaris | 9/2/25 | 9/2/25 | 9/15/25 | 4 | $0.67 | $2.68 | 4.00% | 4.00% |

| PPG | PPG Indus | 11/10/25 | 11/10/25 | 12/12/25 | 4 | $0.71 | $2.84 | 2.80% | 2.70% |

| RBCAA | Republic Bancorp | 9/19/25 | 9/19/25 | 10/17/25 | 4 | $0.45 | $1.80 | 2.50% | 2.50% |

| RGCO | RGC Resources | 10/17/25 | 10/17/25 | 11/3/25 | 4 | $0.21 | $0.83 | 3.90% | 3.90% |

| RLI | RLI | 8/29/25 | 8/29/25 | 9/19/25 | 4 | $0.16 | $0.64 | 1.10% | 1.00% |

| RNR | RenaissanceRe Holdings | 9/15/25 | 9/15/25 | 9/30/25 | 4 | $0.40 | $1.60 | 0.60% | 0.60% |

| ROP | Roper Technologies | 10/3/25 | 10/3/25 | 10/17/25 | 4 | $0.82 | $3.30 | 0.70% | 0.70% |

| RPM | RPM International | 10/20/25 | 10/20/25 | 10/31/25 | 4 | $0.54 | $2.16 | 1.90% | 1.80% |

| RTX | RTX | 8/15/25 | 8/15/25 | 9/4/25 | 4 | $0.68 | $2.72 | 1.70% | 1.70% |

| SBSI | Southside Bancshares | 8/21/25 | 8/21/25 | 9/4/25 | 4 | $0.36 | $1.44 | 5.30% | 5.30% |

| SCL | Stepan | 8/29/25 | 8/29/25 | 9/15/25 | 4 | $0.38 | $1.54 | 3.40% | 3.40% |

| SEIC | SEI Investments | 6/9/25 | 6/9/25 | 6/17/25 | 2 | $0.49 | $0.98 | 1.20% | 1.20% |

| SHW | Sherwin-Williams | 8/15/25 | 8/15/25 | 9/5/25 | 4 | $0.79 | $3.16 | 1.00% | 0.90% |

| SJM | JM Smucker | 8/15/25 | 8/15/25 | 9/2/25 | 4 | $1.10 | $4.40 | 4.20% | 4.10% |

| SON | Sonoco Prods | 11/10/25 | 11/10/25 | 12/10/25 | 4 | $0.53 | $2.12 | 5.30% | 5.30% |

| SPGI | S&P Global | 11/25/25 | 11/25/25 | 12/10/25 | 4 | $0.96 | $3.84 | 0.80% | 0.80% |

| SRCE | 1st Source | 8/5/25 | 8/5/25 | 8/15/25 | 4 | $0.38 | $1.52 | 2.60% | 2.60% |

| SWK | Stanley Black & Decker | 9/2/25 | 9/2/25 | 9/16/25 | 4 | $0.83 | $3.32 | 4.90% | 4.90% |

| SYK | Stryker | 9/30/25 | 9/30/25 | 10/31/25 | 4 | $0.84 | $3.36 | 0.90% | 0.90% |

| SYY | Sysco | 10/3/25 | 10/3/25 | 10/24/25 | 4 | $0.54 | $2.16 | 2.70% | 2.60% |

| TGT | Target | 11/12/25 | 11/12/25 | 12/1/25 | 4 | $1.14 | $4.56 | 5.00% | 5.00% |

| TMP | Tompkins Finl | 8/8/25 | 8/8/25 | 8/15/25 | 4 | $0.62 | $2.48 | 3.90% | 3.90% |

| TNC | Tennant | 8/29/25 | 8/29/25 | 9/15/25 | 4 | $0.29 | $1.18 | 1.50% | 1.50% |

| TR | Tootsie Roll Industries | 10/7/25 | 10/7/25 | 10/16/25 | 4 | $0.09 | $0.36 | 0.80% | 0.80% |

| TROW | T. Rowe Price Group | 9/15/25 | 9/15/25 | 9/29/25 | 4 | $1.27 | $5.08 | 4.90% | 4.90% |

| UBSI | United Bankshares | 9/12/25 | 9/12/25 | 10/1/25 | 4 | $0.37 | $1.48 | 4.20% | 4.20% |

| UGI | UGI | 9/15/25 | 9/15/25 | 10/1/25 | 4 | $0.38 | $1.50 | 4.60% | 4.60% |

| UHT | Universal Health Realty | 9/22/25 | 9/22/25 | 9/30/25 | 4 | $0.74 | $2.96 | 8.20% | 8.20% |

| UMBF | UMB Financial | 9/10/25 | 9/10/25 | 10/1/25 | 4 | $0.40 | $1.60 | 1.50% | 1.50% |

| UVV | Universal | 10/10/25 | 10/13/25 | 11/3/25 | 4 | $0.82 | $3.28 | 6.10% | 6.10% |

| WABC | Westamerica Bancorp | 8/4/25 | 8/4/25 | 8/15/25 | 4 | $0.46 | $1.84 | 3.90% | 3.90% |

| WLY | John Wiley & Sons | 10/7/25 | 10/7/25 | 10/23/25 | 4 | $0.35 | $1.42 | 3.80% | 3.80% |

| WMT | Walmart | 12/12/25 | 12/12/25 | 1/5/26 | 4 | $0.23 | $0.94 | 0.90% | 0.90% |

| WST | West Pharmaceutical Servs | 11/12/25 | 11/12/25 | 11/19/25 | 4 | $0.22 | $0.88 | 0.30% | 0.30% |

| WTRG | Essential Utilities | 8/12/25 | 8/12/25 | 9/2/25 | 4 | $0.34 | $1.37 | 3.30% | 3.20% |

| XOM | Exxon Mobil | 8/15/25 | 8/15/25 | 9/10/25 | 4 | $0.99 | $3.96 | 3.50% | 3.50% |

| YORW | York Water | 9/30/25 | 9/30/25 | 10/15/25 | 4 | $0.22 | $0.88 | 2.80% | 2.80% |

Affiliate

Stock Rover is an award winning investment research platform.

- The site has 8,500+ stocks, 4,000 ETFs, and 40,000 mutual funds.

- Access to 650+ metrics, financial data, market news, stock and fund ratings, fair value, margin of safety, etc.

- Includes brokerage integration, portfolio tracking, rebalancing, watchlists, alerts, future income forecasts, etc.

- Plus export to spreadsheets, dividend calendar, 10+ years of data history, etc.

- Best Buy and Hold Screener by Investopedia

- Editor’s Choice by American Association of Individual Investors (AAII).

Click here to try Stock Rover for free (14-day free trial).

In 2023, four Dividend Champions were promoted to the Dividend Kings list. These stocks achieved a 50-year mark for consecutive annual dividend increases. These companies were Nucor Corporation (NUE), RPM International (RPM), S&P Global (SPGI), and Walmart (WMT).

Additions to the Dividend Champions in 2024

In 2024, McCormick & Company (MKC), Norwood Financial (NWFL), RGC Resources (RGCO), and John Wiley & Sons (WLY) were added to the list of Dividend Champions.

McCormick & Company is the leading producer of spices, seasonings, and flavorings.

Norwood Financial is small bank operating in northeastern Pennsylvania and parts of New York.

RGC Resources is a natural gas utility in Roanoke, Virginia.

John Wiley & Sons sells books, journals, and online content.

Deletions to the Dividend Champions in 2024

In 2024, at least three companies fell off the list. 3M Company (MMM) cut its dividend because of lawsuits and divesting its healthcare segment. It ended a 66-year streak. Second, Leggett & Platt (LEG) cut its dividend after years of lower revenue, earnings per share, and rising debt. Lastly, Telephone and Data Systems (TDS) cut its dividend because of competition in its fiber and cellular businesses.

A few other companies may have also dropped off the list such as and W. P. Carey (WPC).

Other Dividend Stock Lists

The other U.S. stock lists are:

For Canadian stocks, we have an article on

For UK stocks, we have an article on

Other dividend stock lists

FAQs About the 2025 Dividend Champions

What do I like About the Dividend Champions 2025?

The Dividend Champions 2025 list is a screen for further investigating stocks for a dividend growth portfolio. It is a list of companies with stable businesses that have competitive advantages and have returned cash to shareholders consistently through dividends and, in some cases, buybacks over an extended period.

Over -The-Counter Stocks Increase the Number

The number of Dividend Champions increases if we include over-the-counter (OTC) stocks. As a result, the total universe of U.S. stocks goes up to about 12,000. Several small banks and other equities are not traded on the NYSE or NASDAQ and are thus not included in this list. For example, Farmers & Merchants Bancorp (FMBC) has raised its dividend for 50 years. However, the stock is thinly traded on the OTC market. Another example is Eagle Financial Services (EFSI), which has raised the dividend for 35 years but is also a thinly traded on the OTC market. There are higher risks with thinly traded stocks, and we do not include them in this list.

In addition, the list changes slowly. However, even during extreme economic duress, such as the COVID-19 pandemic, only a handful of companies dropped off the list each year. This fact points to the resiliency of the businesses on the Dividend Champions 2025 list and management’s commitment to the dividend.

Affiliate

Portfolio Insight is a leading portfolio management and research platform.

- 9,000+ stocks and ETFs in its database

- Access up to dozens of metrics, 20-years of financial data from S&P Global, fair value, margin of safety, charting, etc.

- Avoid dividend cuts with the Dividend Quality Grade and screening tools.

Click here to try Portfolio Insight for free (14-day free trial).

What are the Differences Between the Dividend Champions and Dividend Aristocrats

The Dividend Champion 2025 list is broader and more comprehensive than the Dividend Aristocrat list. A stock must only meet the requirement for raising the dividend for 25+ years to be added to the Dividend Champions List. However, the criteria for inclusion as a Dividend Aristocrat is stricter. In addition to the 25+ years of dividend increases, a stock must be a part of the S&P 500 Index, have a minimum market capitalization of $3 billion, and meet trading volume and sector weighting requirements.

Hence, a stock can be a Dividend Champion but not a Dividend Aristocrat.

What are the Differences Between Dividend Champions and Dividend Kings

The Dividend Kings are more exclusive than the Dividend Champions. To become a Dividend King, a stock must raise its dividend for 50+ consecutive years, a much harder achievement. However, a company can be a Dividend King, a Dividend Champion, and a Dividend Aristocrat. For instance, The Coca-Cola Company (KO) is found on all three lists.

Two MLPs and Six REITs Are on the Dividend Champions 2025 List

The 2025 Dividend Champions list contains many banks, utilities, consumer defensive, and industrial companies.

The list includes two Master Limited Partnerships (MLPs): Enbridge (ENB) and Enterprise Products Partners (EPD).

The Dividend Champions list has six Real Estate Investment Trusts (REITs): Essex Property Trust (ESS), Federal Realty Investment (FRT), National Retail Properties (NNN), Realty Income (O), and Universal Health Realty (UHT).

In addition, W.P. Carey will fall off the list in 2025 because it reduced the quarterly payout.

Related Articles About REITs on Dividend Power

What is the Sector and Industry Breakdown?

Companies from the Financial sector have the most significant representation on the Dividend Champions 2025 list, with 32 companies, followed by the Industrial sector, with 27 companies. The Consumer Defensive sector has 20, and Utilities has 16 Companies. The lowest representation is from the Communications Services sector, with one company.

Financials tend to have stable and generally rising earnings over time. There are 19 regional banks, six insurance companies, three asset managers, and two financial data & two stock exchanges on the list of Dividend Champions. Regional banks are often conservative; they have room to expand, allowing for earnings per share and dividend growth. Insurance and asset manager companies have sticky customers and grow with time.

Industrial companies tend to have somewhat more volatile earnings and cash flows, but many have conservative payout ratios, allowing them to grow dividends during recessions and economic downturns. The list includes ten specialty industrial machinery companies and one conglomerate.

Consumer Defensive companies tend to have predictable earnings and cash flows that grow slowly with time. Many did well during the COVID-19 pandemic. Larger companies in this sector tend to acquire smaller ones, leading to industry consolidation. Five household & personal products companies and four packaged food companies are on the list, including several well-known ones.

Market Size of the Dividend Champions 2025

Large-cap companies do not dominate the list, which includes quite a few mid-cap ($2 billion – $10 billion) and small-cap ($300 million – $2 billion) companies.

Walmart (WMT) is the largest dividend champion by market capitalization, and RGC Resources (RGCO) is the smallest. As mentioned before, the list does not include some small OTC stocks.

Who’s On Deck?

At the start of the year, several companies on the Dividend Contender List have raised the dividend for 24 years. This number includes Brown-Forman (BF.A), Fastenal (FAST), Norwood Financial (NWFL), RGC Resources (RGCO), and John Wiley & Sons (WLY). These stocks will become Dividend Champions, assuming they raise their dividend in 2025.

Prior Year Lists and Articles

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more. It is an excellent resource for DIY dividend growth investors and retirees.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor, analyst, and writer on dividend growth stocks and financial independence. His writings can be found on Seeking Alpha, InvestorPlace, Business Insider, Nasdaq, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial sites. In addition, he is part of the Portfolio Insight and Sure Dividend teams. He was recently in the top 1.0% and 100 (73 out of over 13,450) financial bloggers, as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.