As we move closer to 2025, the financial landscape continues to evolve at a rapid pace. With advancements in technology, shifting economic conditions, and changing consumer behaviors, it is crucial to stay informed and adapt our financial strategies accordingly. Whether you’re a seasoned investor or someone just starting out on their financial journey, here are some essential money tips to help you future-proof your finances.

1. Embrace Digital Banking and Financial Management

In an increasingly digital world, traditional banking is being rapidly replaced by online and mobile banking solutions. By 2025, it is expected that the majority of banking transactions will be conducted via mobile apps. Embrace this trend by setting up an online bank account that offers low fees, high interest rates, and easy access to your funds.

Moreover, utilize financial management apps. These tools can help you track your income and expenses, budget effectively, and even provide insights into your spending patterns. By keeping a close eye on your finances, you can make informed decisions, avoid unnecessary expenditures, and save for future goals.

2. Prioritize Emergency Savings

Life is unpredictable, and having a financial safety net is more important than ever. Aim to save at least three to six months' worth of living expenses in an easily accessible account. This emergency fund will provide peace of mind and ensure you can handle unforeseen events, such as medical emergencies, job loss, or major home repairs without derailing your financial plans.

3. Invest in Diversification

Diversification is key to a robust investment strategy. With the rise of alternative investment options, from cryptocurrencies to real estate crowdfunding, it is crucial to spread your investments across various asset classes. By 2025, consider incorporating:

- Stocks and Bonds: Traditional investments remain a staple. Look for diverse sectors and consider adding ethical or sustainable companies to your portfolio.

- Cryptocurrencies: While volatile, cryptocurrencies can offer high returns. Conduct thorough research and allocate only a portion of your investment to this emerging market.

- Real Estate: Real estate can provide passive income and long-term appreciation. Explore options like Real Estate Investment Trusts (REITs) for a more hands-off approach.

- Peer-to-Peer Lending: Consider platforms that allow you to lend money to individuals or small businesses, earning interest over time.

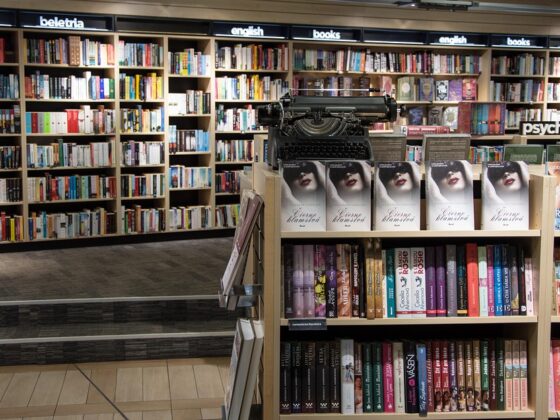

4. Keep Up with Financial Literacy

Financial literacy is a lifelong journey. As markets and regulations change, so should your knowledge. Invest time in educating yourself about financial concepts, investment strategies, and economic trends. Utilize resources like online courses, financial blogs, podcasts, and books. Understanding the fundamentals of economics and personal finance will enable you to make better decisions and capitalize on emerging opportunities.

5. Plan for Retirement Early

Don’t underestimate the importance of retirement savings. The earlier you start saving for retirement, the more you can benefit from compound interest. By 2025, consider increasing contributions to retirement accounts such as a 401(k) or an IRA. Aim for at least 15% of your income, and don't hesitate to take advantage of employer matching contributions, as this is essentially free money.

Also, think about diversifying your retirement savings across various investment vehicles to mitigate risk as you age. A mix of stocks, bonds, and other investments will help ensure your nest egg grows steadily and remains secure.

6. Understand the Impact of Inflation

Inflation can erode your purchasing power, making it imperative to factor this into your financial planning. As we approach 2025, understand how inflation might impact your savings and investments. One effective strategy is to invest in assets that typically outpace inflation, such as equities or real estate.

Also, consider inflation-protected securities, like TIPS (Treasury Inflation-Protected Securities), which adjust with inflation and provide added security for your portfolio.

7. Be Cautious with Debt

While loans can be useful for major purchases like homes or education, it’s essential to manage debt wisely. By 2025, aim to minimize high-interest debts, such as credit card balances, which can quickly become unmanageable. Focus on paying off debt aggressively before taking on new financial obligations.

Additionally, familiarize yourself with repayment strategies, such as the snowball or avalanche methods, to efficiently tackle your debt. Understanding interest rates and terms will empower you to make informed choices about borrowing.

8. Stay Adaptable

Finally, the ability to adapt to changing circumstances is crucial in today’s volatile financial environment. The world of finance is ever-evolving, with new technologies, regulations, and economic challenges emerging regularly. Stay flexible and open to new ideas, and be willing to adjust your financial strategies as necessary to align with market conditions and your personal circumstances.

FAQs

Q1: What is the best way to start budgeting?

A1: Start by tracking your income and expenses for a month to identify patterns. Use budgeting apps or spreadsheets to categorize your spending. Aim to allocate funds towards savings, essentials, and discretionary spending. Adjust categories as needed based on your financial goals.

Q2: How much should I save for retirement?

A2: Aim to save at least 15% of your income for retirement, but this percentage can vary based on your age, retirement goals, and other factors. The earlier you start, the more beneficial compound interest will be.

Q3: Should I invest in cryptocurrency?

A3: Cryptocurrencies can be highly volatile. If you choose to invest, start small and only invest money you can afford to lose. Do thorough research and consider diversifying within this asset class.

Q4: What’s a reasonable amount for an emergency fund?

A4: Aim to save three to six months' worth of living expenses in your emergency fund. This amount can provide a cushion for unexpected financial setbacks.

Q5: How can I improve my financial literacy?

A5: Utilize online resources such as financial blogs, podcasts, courses, and books. Engage in conversations with financial professionals or join community workshops to stay informed and enhance your understanding of financial matters.

By taking these proactive steps, you can set yourself up for success and financial wellness as we approach 2025. Remember, the key to future-proofing your finances is not just about saving and investing wisely but also about being educated and adaptable in a changing financial landscape.