Trading in the stock market can be a highly rewarding but also a challenging endeavor. With the right knowledge and strategies, you can significantly boost your trading game and increase your chances of success. Whether you are a beginner or an experienced trader, these insider tips can help you take your trading to the next level.

1. Stay Informed

One of the most important things you can do to improve your trading game is to stay informed about market trends, news, and events that can impact the stock market. Follow financial news outlets, read market reports, and keep an eye on economic indicators. This will help you make well-informed decisions when trading.

2. Develop a Trading Plan

Having a trading plan is essential for success in the stock market. Your trading plan should outline your goals, risk tolerance, trading strategy, and rules for entering and exiting trades. Stick to your plan and avoid making impulsive decisions based on emotions or market noise.

3. Manage Your Risk

Risk management is crucial in trading. Never risk more than you can afford to lose on a single trade, and use stop-loss orders to limit your losses. Diversify your portfolio to reduce risk, and avoid putting all your eggs in one basket.

4. Keep Emotions in Check

Emotions can cloud your judgment and lead to poor decision-making in trading. Practice discipline and control your emotions when trading. Stay calm and rational, even in volatile market conditions.

5. Learn from Your Mistakes

Every trader makes mistakes. It's important to learn from your failures and use them as valuable learning experiences. Analyze your trades, identify what went wrong, and make adjustments to improve your future trading performance.

6. Stay Disciplined

Discipline is key to success in trading. Stick to your trading plan, follow your rules, and avoid deviating from your strategy. Set realistic goals and be patient – success in trading doesn't happen overnight.

7. Stay Consistent

Consistency is essential in trading. Develop a routine and trading schedule that works for you, and stick to it. Avoid chasing after hot tips or trying to time the market – consistency will lead to long-term success.

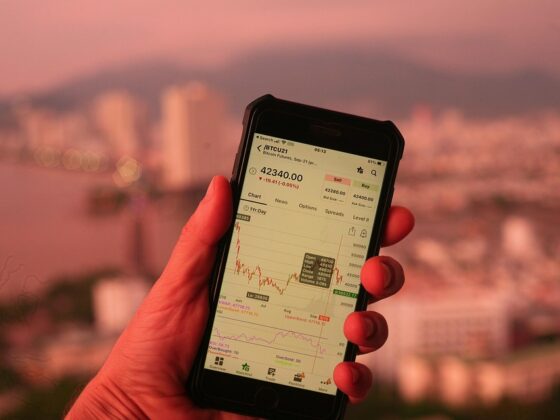

8. Use Technical Analysis

Technical analysis involves analyzing price charts and patterns to predict future price movements. Learn how to use technical indicators and chart patterns to make informed trading decisions. Technical analysis can be a powerful tool in your trading arsenal.

9. Stay Humble

Trading can be a humbling experience. No matter how experienced you are, there will always be factors beyond your control. Stay humble, be open to learning, and be willing to adapt to changing market conditions.

10. Practice Patience

Success in trading requires patience. Don't expect instant results or try to force trades. Wait for the right opportunities and be patient with your trading strategy. Rome wasn't built in a day, and neither is a successful trading career.

Frequently Asked Questions (FAQs):

Q: How much money do I need to start trading?

A: The amount of money you need to start trading will depend on your trading strategy, risk tolerance, and goals. Some brokers allow you to open an account with as little as $500, while others may require a larger initial investment. Start small and gradually increase your trading capital as you gain experience.

Q: What is the best trading strategy for beginners?

A: The best trading strategy for beginners is one that is simple, easy to understand, and suits your personality and risk tolerance. Consider starting with a trend-following strategy or a long-term investing approach. Avoid complex trading systems or strategies that you don't fully understand.

Q: How can I avoid losses in trading?

A: While it's impossible to completely eliminate losses in trading, you can minimize your risk by using proper risk management techniques, such as setting stop-loss orders, diversifying your portfolio, and avoiding emotional decision-making. Remember that losses are a natural part of trading, and focus on managing them effectively rather than trying to avoid them altogether.

Q: How do I know when to enter and exit trades?

A: Knowing when to enter and exit trades is a crucial aspect of trading success. Use technical analysis, market research, and your trading plan to identify entry and exit points. Set clear criteria for entering and exiting trades, and stick to your rules to avoid making impulsive decisions.

In conclusion, improving your trading game requires knowledge, discipline, and practice. By following these insider tips and staying informed about market trends, you can enhance your trading skills and increase your chances of success. Remember to stay disciplined, manage your risk, and learn from your mistakes. With dedication and hard work, you can take your trading to the next level and achieve your financial goals.