With fears of a recession rising again largely thanks to the Trump administration’s aggressive policy measures—tariffs, spending cuts, aggressive layoffs, and an increasingly combative trade stance—it’s time to awaken the vulture investor within. Both Main Street and Wall Street are at risk of losing a lot of money now.

I don’t particularly enjoy the idea of being a vulture investor. It feels exploitative, capitalizing on the misfortune of others. But in a capitalistic society, opportunism isn’t just encouraged—it’s essential for survival. If the rapid indiscriminate firings of federal government employees teach us anything, it's that the rich and powerful don't care about you! Therefore, you must change your mindset to go on the offensive.

Every market downturn triggers a wealth transfer, moving money from the unprepared to the prepared, from the weak to the strong. If you refuse to adopt a vulture mindset during uncertain times, you risk becoming the prey. Embracing this approach is both a defensive safeguard and an offensive strategy for seizing opportunities.

A Bear Market Could Easily Come Back

We’ve just experienced two phenomenal years of stock market returns. A natural reversion to the historical valuation mean of 18x earnings could easily pull the S&P 500 down by 15% or more from current levels. If so, we should expect to see an acceleration of mass layoffs.

While that downside move may seem extreme, so is the ongoing tariff flip-flopping, which ultimately hurts consumer sentiment. Think about it—if confidence in the future fades, the logical response is to save, not spend. If too many people start saving, a recession ensues.

Although the NASDAQ has corrected by 10% already, there’s not exactly blood on the streets yet, with the S&P 500 only down about 6.5% from its peak. However, if self-inflicted wounds continue to mount, a savvy vulture investor knows to keep cash ready to pounce on emerging opportunities.

The Goal of a Vulture Investor

A vulture investor’s mission is simple: identify distressed assets, wait for capitulation, and strike when the price is right.

Like actual vultures circling the dying, financial vultures must exercise patience and discipline. Instead of chasing assets at inflated prices, you must wait for forced sellers—those who can no longer hold on due to excessive debt, economic hardship, or mismanagement.

I've made vulture investing sound immoral due to the word “vulture.” I could have easily changed the term to “Opportunity Investing” or “Strategic Investing” to make being opportunistic sound better. However, in a free market, most of us have the ability to buy or sell anything we want.

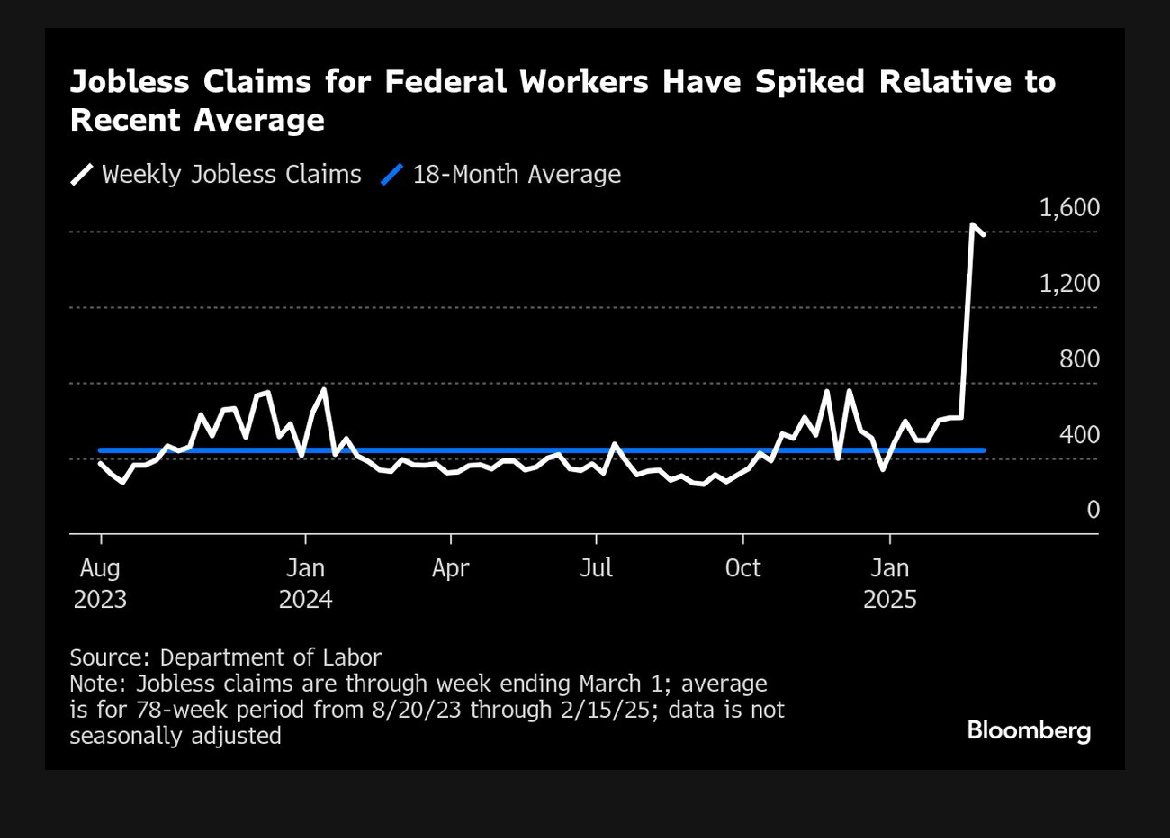

The early warning signs are already here:

Job cuts are accelerating – Companies are trimming fat, preparing for leaner times. Layoffs ripple through local economies, creating secondary distress in housing, consumer spending, and small business revenues.

Household debt levels and delinquencies are inching higher – Some homeowners stretched themselves thin to afford property at historically low interest rates. While credit card debt and auto loan debt continue to rise. With rates still elevated, carrying costs are biting hard.

Commercial real estate remains fragile – Office vacancies are still high, and if companies start downsizing further, landlords with too much leverage could be in big trouble.

Erratic and unpredictable government – When government actions are inconsistent, it becomes difficult to make reliable projections about a company's performance and the broader economy's direction. The free market wants less government intervention, not more.

GDP growth is decelerating or may even be declining – The Atlanta Fed is forecasting 1Q2025 GDP growth of -1.5%.

Who to Prey On as a Vulture Investor

To capitalize, vulture investors must know where to look for opportunity. So long as the investment is legal, it is within your right to take advantage of the situation. Here are some targets to consider:

1. Homeowners Who Overleveraged

During the post-pandemic housing boom, many buyers ignored traditional affordability rules. Instead of following the 30/30/3 rule (spend no more than 30% of gross income on a mortgage, put down at least 30%, and don’t buy a home more than 3x your annual income), they stretched themselves thin, banking on low mortgage rates and rising home prices.

Now, with persistently high interest rates and rising layoffs, forced selling and foreclosures could increase. This may be especially true in states that overbuilt, such as Florida, Texas, Tennessee, and Colorado. Additionally, mass layoffs in the Washington D.C. area could lead to a surge in home listings as homeowners downsize. A savvy vulture investor monitors foreclosure trends and waits patiently for properties to hit auction at steep discounts.

2. Small Business Owners Who Took On Too Much Debt

The surge in small business formation during 2020-2022 was impressive, but many businesses survived on cheap debt and government aid. Now, with higher borrowing costs and weaker consumer spending, those without strong cash flow or pricing power will struggle.

As a vulture investor, you can look for:

• Businesses forced to liquidate assets at discounts (real estate, equipment, intellectual property).

• Acquiring distressed companies with strong fundamentals but short-term cash flow issues.

• Buying into struggling but promising startups at fire-sale valuations. During downturns, client growth slows and it's much harder to get funding.

3. Overleveraged Commercial Real Estate Owners

Although recovering, the commercial real estate sector remains in a precarious position. If a recession hits, the post-pandemic return-to-office trend may stall, as companies will freeze hiring or downsize, reducing office space demand further.

Meanwhile, many landlords refinanced their properties at rock-bottom interest rates and are now facing ballooning debt payments with few options to refinance affordably. Those who can’t restructure will be forced to sell, creating prime opportunities for deep-pocketed investors.

4. Large Corporations With Excessive Debt

Corporate debt levels soared when rates were near zero. Now, with borrowing costs much higher, overleveraged firms face an earnings squeeze. The weakest companies will:

• Sell off divisions or assets at distressed prices.

• Restructure through bankruptcy, wiping out existing shareholders.

• Issue dilutive secondary stock offerings to stay afloat.

Vulture investors can profit by:

• Buying bonds of distressed companies at steep discounts.

• Acquiring cash-generating divisions spun off by struggling firms.

• Short-selling overvalued, debt-laden companies before they collapse.

5. Panic Sellers in the Stock Market

The beauty and curse of the stock market is its emotional nature. Fear-driven selling can create incredible bargains, much like we saw in March-April 2020 when great companies were trading at absurdly low valuations.

Vulture investors:

• Build a watchlist of high-quality companies with strong fundamentals (strong free cash flow, large balance sheets, large moat, etc) that may get unfairly punished by panic.

• Look for indiscriminate selling based on macroeconomic and policy-driven panic rather than company-specific problems.

• Use dollar-cost averaging to buy in phases as prices fall further.

6. Former Startup Employees with Illiquid Stock

In difficult times, some employees holding stock options or equity in private companies may look to offload their shares at a discount. Vulture investors can:

- Buy shares in struggling but promising private companies on the secondary market.

- Look for pre-IPO companies with strong fundamentals but temporary cash flow issues.

- Negotiate with ex-employees who need liquidity before a company can go public or be acquired.

7. Vacation Homeowners Hit by Rising Costs

Many buyers rushed into vacation homes during the pandemic, expecting strong rental demand to subsidize operating costs. Now, with higher mortgage rates, insurance costs, and a slowdown in vacation home purchases, some are struggling to hold on. Vulture investors can:

- Scoop up discounted vacation properties in overbuilt markets.

- Target Airbnb investors who can no longer cover their costs.

- Look for resort-area real estate owned by overleveraged investors.

8. Distressed Luxury Asset Sellers

Economic downturns often force individuals to sell luxury assets at a discount. Opportunities include:

- High-end watches from brands like Rolex and Patek Philippe.

- Classic and exotic cars that require costly maintenance.

- Yachts and private planes from owners looking to downsize their lifestyles.

9. Overleveraged Crypto and NFT Speculators

The crypto boom led many investors to borrow against their digital assets. Now, with crypto market volatility, some may be forced to sell:

- Bitcoin, Ethereum, and other assets at distressed prices.

- High-value NFTs from collections like Bored Ape Yacht Club or CryptoPunks.

- Crypto-backed real estate and other assets that have gone underwater.

10. Landlords Struggling with Rent Control and Evictions

In cities with strict rent control laws or slow eviction processes, some landlords may be unable to raise rents or remove non-paying tenants. This can push them to sell properties below market value. Vulture investors can:

- Target distressed multi-family properties where owners are tired of dealing with regulations.

- Buy single-family rentals from landlords who can’t keep up with rising costs and stagnant rent growth.

- Seek out mom-and-pop landlords looking to exit the rental business altogether.

11. Divorcees Facing Asset Liquidation

Divorce often forces the sale of assets, including homes, businesses, and investment portfolios, at inopportune times. One spouse may need to offload real estate quickly to divide assets, or a business could be sold below fair value to settle a split. Vulture investors can:

- Identify luxury properties being sold at a discount due to divorce settlements.

- Look for businesses that one spouse is forced to sell, especially those with strong fundamentals but temporary distress.

- Buy out investment portfolios or private equity stakes that one spouse needs to liquidate.

12. Overleveraged Car Owners Facing Repossession

Buying too much car is the #1 personal finance wealth killer. This realization led me to develop the home-to-car value ratio, a simple guideline to help people make smarter spending decisions. The recent surge in car loan delinquencies suggests that many owners, particularly those with luxury vehicles, are struggling to keep up with their payments. Vulture investors can:

- Buy repossessed vehicles at auction for resale or rental fleets.

- Offer private-party cash deals to desperate sellers before repossession.

- Acquire car rental businesses liquidating their inventory due to financial struggles.

The Power of Cash: Your Ultimate Weapon

The best vulture investors don’t just recognize opportunity—they have the liquidity and the courage to act. Most people who get into trouble do so by taking on excessive debt, leaving them vulnerable when a downturn hits.

One of the biggest risks in a downturn is being forced to sell assets at the worst time. Savvy investors avoid this fate by maintaining strong cash reserves and having a clear game plan for when to deploy capital.

If you’re sitting on cash, a downturn isn’t something to fear—it’s an opportunity. The more uncertainty and panic in the market, the more negotiating power you have as a buyer.

Forget about only have six months of living expenses in cash. A vulture investor has years of cash ready to deploy!

So Rich You Don’t Care How Much You Temporarily Lose

One of the biggest dangers of electing billionaires policymakers to run the economy is that they might not feel as much pain as the rest of us during downturns. When you have hundreds of millions or billions in wealth, losing a lot of money means nothing.

But for the average investor, homeowner, or small business owner, a downturn can be catastrophic. That’s why thinking like a vulture investor isn’t just about making money—it’s about financial survival. You hope you never have to go into vulture investing mode, but you're prepared if you need to.

Whether you like it or not, downturns can create life-changing opportunities for those who are prepared. Those who gobbled up stocks and real estate during the 2008 Global Financial Crisis are sitting on huge fortunes today. Meanwhile, those who sold stocks and foreclosed on their homes back then have likely fallen behind for good.

If history is any guide, wealth will once again transfer from the weak to the strong, from the overleveraged to the liquid, from the fearful to the opportunistic.

The question is: Which side will you be on?

Suggestions To Boost Your Finances

To better plan for your financial future, check out ProjectionLab. It allows you to create multiple “what-if” scenarios to prepare for any situation. The more you plan, the better you can optimize your financial decisions.

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Your shares, ratings, and reviews are appreciated.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009. Everything is written based on firsthand experience and expertise.