Dow Inc. (DOW) cut its dividend due to the impact of a prolonged chemical industry downturn, poor financial results, leverage, tariffs, and trade uncertainty. Weak financial results and lower sales and earnings for a longer than expected time have taken a toll. The firm’s dividend has been constant since Q2 2019, and it was eventually cut this year.

The share price has fallen dramatically since the middle of 2022. Investors sold this dividend stock due to concerns about poor results and a potential dividend cut, as safety concerns increased. Depending on industry recovery and future operating and financial results, another reduction may occur.

Affiliate

Stock Rover is an award winning investment research platform.

- The site has 8,500+ stocks, 4,000 ETFs, and 40,000 mutual funds.

- Access to 650+ metrics, financial data, market news, stock and fund ratings, fair value, margin of safety, etc.

- Includes brokerage integration, portfolio tracking, rebalancing, watchlists, alerts, future income forecasts, etc.

Click here to try Stock Rover for free (14-day free trial).

Overview of Dow Inc.

Dow Inc. was founded over 100 years ago in 1898 and is headquartered in Midland, MI. Today, it is a large global chemical and materials science company. The current organizational structure was finalized after Dow merged with DuPont in 2017, and the materials science division was subsequently spun off in 2019, resulting in the creation of the Dow Chemical Company.

The firm operates through three segments: Packaging & Specialty Plastics (52% of revenue), Industrial Intermediates & Infrastructure (28% of revenue), and Performance Materials & Coatings (20% of revenue). It also operates through four market verticals: packaging (30% of revenue), infrastructure (40% of revenue), consumer (20% of revenue), and mobility (10% of revenue). Major subsidiaries include Rohm and Haas and Dow Corning, and it operates several joint ventures.

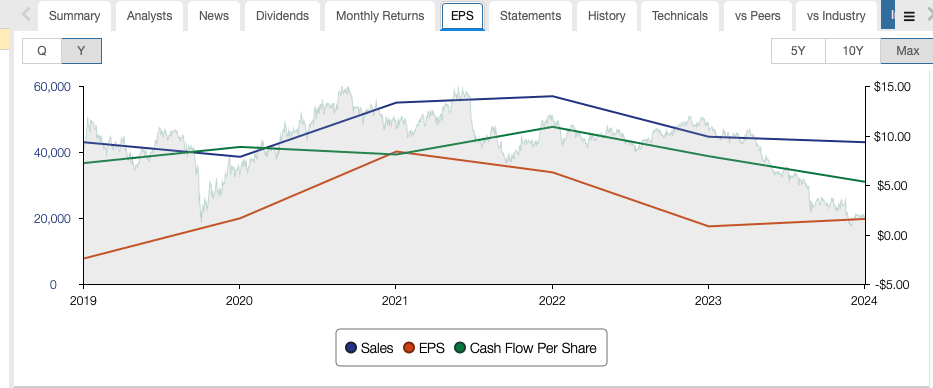

Total revenue was $42,964 million in 2024 and $41,819 million in the past twelve months.

Dividend Cut Announcement

During the second quarter of 2025, on Thursday, July 24th, Dow Inc. (DOW) cut its dividend. The company’s quarterly dividend rate was $0.70 per share before the announcement. The dividend is now $0.35 per common share, a 50% reduction. In the announcement on July 24th, the company stated,

“…that its Board of Directors has declared a dividend of 35 cents per share. The adjustment in payout size reflects Dow’s balanced capital allocation approach and enhances financial flexibility amidst a persistently challenging macroeconomic environment.”

“Today’s announcement aims to ensure we maximize long-term shareholder value as we navigate a prolonged industry downturn and the resulting lower-for-longer earnings environment. With this adjustment, we are aligning the payout size to provide additional financial flexibility. Doing so ensures Dow’s ability to prioritize the highest return-generating opportunities, while maintaining a competitive dividend,” said Jim Fitterling, Dow chair and CEO.

“Our capital allocation approach remains unchanged, and we are committed to delivering leading shareholder returns over the cycle. As the industry recovers, Dow is positioned to deliver profitable growth by unlocking the full benefit of our growth investments, improving margins, implementing our cost reduction initiatives, and further strengthening our competitive advantages.”

Later, in the second quarter earnings call transcript, the CEO stated,

“…50% dividend reduction effective in the third quarter of this year,” stating, “this is the most prudent way to maintain financial flexibility and maximize long-term value for our shareholders.” He emphasized commitment to a “competitive dividend across the economic cycle”

Effect of the Change

By cutting the dividend by 50%, Dow aimed to reduce its quarterly and annual distributions, thereby increasing its financial flexibility. The firm is experiencing lower earnings for longer than expected because of a prolonged industry downturn. Additionally, free cash flow was negative in 2024, and the balance sheet is leveraged with low interest coverage.

The company’s dividend rate has been constant since Q2 2019, so it did not have a streak of increases. The firm was not a dividend growth stock. The result is that less free cash flow (FCF) is required for the dividend distribution, allowing the retailer to reduce debt and finance growth.

Challenges

Dow is facing a challenging business environment due to an industry downturn, resulting in lower earnings. Tariffs and trade uncertainties are exacerbating sales weakness and probably affecting profits. Additionally, the balance sheet is leveraged, and interest coverage has declined.

Chemical Industry Downturn

The chemical industry is facing a prolonged downturn in a cyclical business. Dow’s primary end markets are automotive, packaging, building & construction, industrial, consumer, and healthcare. Some of the end markets are facing a demanding environment. For instance, manufacturing is contracting, automotive sales are down, and the building & construction industries are experiencing lower activity. As a result, Dow’s sales have declined from their peak in 2022 by over $10 billion annually. In turn, this has reduced FCF and earnings per share, affecting dividend coverage. The timing of an industry recovery is currently uncertain.

Tariffs and Trade Uncertainty

Tariffs are another major concern for Dow. The company operates globally and likely exports products from other countries into the United States and vice versa. Tariffs are a direct cost to importers and will be passed on to consumers.

Debt and Leverage

Dow is a leveraged firm with over $15 billion in net debt. It currently has approximately 1.19 times interest coverage and a leverage ratio of about 2.92 times. However, it has an investment-grade credit rating of BBB/Baa2, reflecting poor financial performance and expectations of weaker earnings. Additionally, the company’s dividend payout was elevated, and it was conducting share repurchases despite poor financial results.

Dividend Safety

Because of weaker revenue and earnings per share (“EPS”), Dow’s dividend safety metrics were poor. EPS has fallen since its recent peak in 2021 at $8.38. However, it declined in 2022 to $6.28 per share and fell further in 2023 to $0.82 per share. Consensus estimates indicate a loss of ($1.01) per share in 2025.

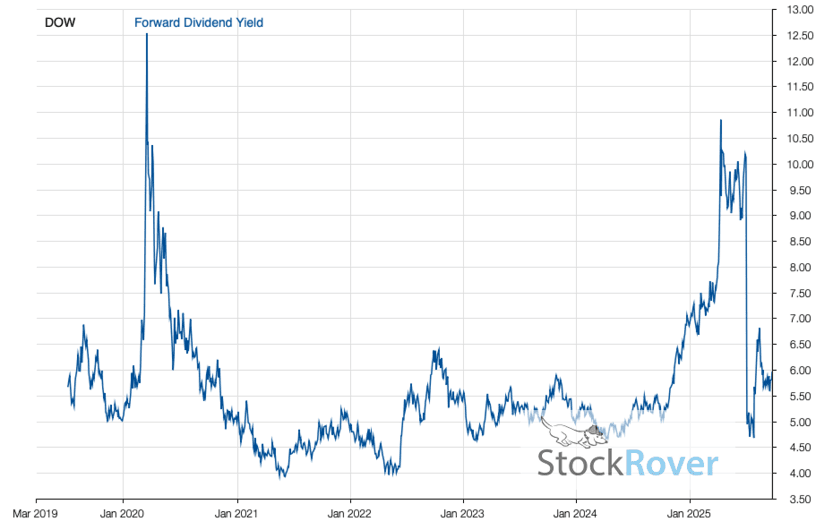

As shown in the chart below from StockRover*, the dividend yield increased rapidly to over 10%. This percentage is a value usually associated with a distressed company. Also, it was much greater than the 4-year average of 5.94%. After reducing the dividend by approximately 50%, the forward dividend yield is now around 5.96%. The quarterly rate is $0.35 per share. However, the yield is still considerably higher than that of the S&P 500 average.

The annual dividend now requires about $992.6 million ($1.40 yearly dividend x 709 million shares), compared to $1,966 million in 2024. However, because EPS will likely be negative in 2025, earnings will not cover the annual dividend distribution, and the payout ratio will be negative. We expect the yearly difference in cash flow requirements to enhance liquidity and finance operations.

Although the dividend is in a better position and more secure now, the firm’s dividend is still not entirely safe. Further decline in demand, poor operating and financial results, or increased tariffs and trade uncertainty may result in another dividend cut.

Consequently, we view the equity as at risk for another dividend cut unless results improve.

Final Thoughts on Dow (DOW) Dividend Cut

A prolonged industry downturn and weak end markets have impacted sales and profitability. Lower earnings for a longer-than-anticipated period, leverage, and low interest coverage have caused difficulties for Dow. Tariffs and trade uncertainty have further complicated matters in 2025. The combined effect resulted in declining dividend safety metrics. As a result, Dow cut its dividend. However, we view the company as at risk for another substantial reduction.

Related Articles on Dividend Power

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more. It is an excellent resource for DIY dividend growth investors and retirees.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

- Portfolio Insight is the newest and most complete portfolio management tool with built-in stock screeners. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor, analyst, and writer on dividend growth stocks and financial independence. His writings can be found on Seeking Alpha, InvestorPlace, Business Insider, Nasdaq, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial sites. In addition, he is part of the Portfolio Insight and Sure Dividend teams. He was recently in the top 1.0% and 100 (73 out of over 13,450) financial bloggers, as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.