The end of the year is often a time for investors to buy and sell stocks and clean up portfolios. Some investors allocate excess cash to new investments or add to existing holdings. Therefore, we discuss 5 stocking stuffer stocks for Christmas 2025.

It makes sense to review your portfolio and add to undervalued stocks with the potential for solid total returns. Alternatively, some stocks that were overvalued for years are now more reasonably priced.

We emphasize dividend stocks and provide a list of five stocking stuffer stocks to consider buying before Christmas 2025. Some are undervalued because of recession fears, and others face company-specific issues. But they are attractively priced with dividend yields greater than the S&P 500 Index and solid dividend safety.

Affiliate

Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more.

Stocks to Buy Before Christmas 2025

S&P Global Inc. (SPGI)

S&P Global is a global provider of financial services and business information, with revenue exceeding $15 billion. Through its various segments, it provides credit ratings, benchmarks and indices, analytics, and other data to commodity market participants, capital markets, and automotive markets.

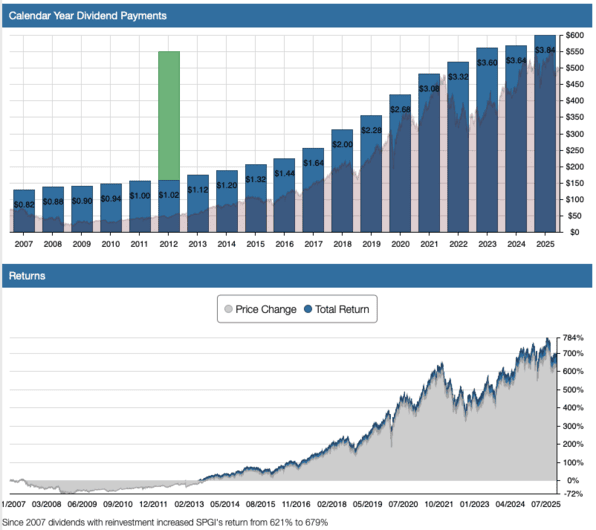

S&P Global has paid dividends continuously since 1937 and has increased its payout for 52 consecutive years, and it is one of the newest members of the prestigious Dividend Kings.

S&P posted third-quarter earnings on October 30th, 2025. The company reported adjusted earnings per share of $4.73, which was 32 cents above estimates. Earnings were up sharply from $3.89 a year ago. Revenue was up almost 9% year-on-year to $3.89 billion, beating estimates by $60 million.

Expenses were $2.22 billion, flat to the prior quarter, and up from $2.17 billion a year ago. Adjusted operating margin expanded once again to 52.1% of revenue.

The company entered into an agreement to buy the private firm With Intelligence for $1.8 billion. The transaction is expected to close late this year or early next year, and should be slightly dilutive to EPS in 2026, followed by accretion in the years after.

We expect annual returns of 13% over the next five years.

Related Articles About S&P Global on Dividend Power

Eversource Energy (ES)

Eversource Energy is a diversified holding company with subsidiaries that provide regulated electric, gas, and water distribution services in the Northeast United States. It serves more than four million utility customers. The regulated utility is organized into the following operating segments. It is our second stocking stuffer stock to buy before Christmas this year.

The Electric Distribution segment is comprised of the distribution businesses of The Connecticut Light and Power Company, NSTAR Electric Company, and the Public Service Company of New Hampshire. These subsidiaries distribute electricity to retail customers in Connecticut, Massachusetts, and New Hampshire.

The Electric Transmission segment includes transmission facilities owned by the three subsidiaries of the Electric Distribution segment. These transmit electricity throughout New England.

The Natural Gas Distribution segment includes the NSTAR Gas, EGMA, and Yankee Gas subsidiaries. Together, these distribute natural gas to more than 900,000 customers throughout Massachusetts and Connecticut.

Lastly, the Water Distribution segment operates five separate regulated water utilities in Connecticut, Massachusetts, and New Hampshire. These businesses serve nearly 250,000 customers in 73 towns and cities.

On November 4th, ES released its third-quarter earnings report for the period ended September 30th, 2025. The company’s total operating revenue grew 5.1% year over year to $3.22 billion during the quarter.

Higher base distribution rates and continued system investments were the drivers behind this topline growth in the quarter. ES posted $1.19 in non-GAAP EPS for the quarter, which was up 5.3% over the year-ago period. That topped the analyst consensus by $0.04 during the quarter.

We expect annual returns of 13% over the next five years. ES has increased its dividend for 27 years, making it a Dividend Aristocrat. According to Stock Rover*, the forward dividend yield is 4.4%.

Related Articles About Eversource Energy on Dividend Power

Roper Technologies (ROP)

Roper Technologies is a specialized industrial company that manufactures products such as medical and scientific imaging equipment, pumps, and material analysis equipment. It also develops software solutions for the healthcare, transportation, food, energy, and water industries. The company generates around $7.0 billion in annual revenues.

On October 23rd, 2025, Roper posted its Q3 results for the period ending September 30th, 2025. Quarterly revenues and adjusted EPS were $2.02 billion and $5.14, up 14% and 11% year-over-year, respectively.

Organic growth was 6%, with acquisitions contributing 8%, reflecting continued strength across Roper’s diversified software and technology portfolio. During the quarter, the company deployed $1.3 billion toward strategic acquisitions, including Subsplash and several bolt-on deals, while continuing to advance AI-driven innovation across its businesses.

Management modestly adjusted its full-year 2025 adjusted EPS guidance to a range of $19.90 to $19.95 (from $19.90 to $20.05 previously) to reflect minor dilution from recent acquisitions.

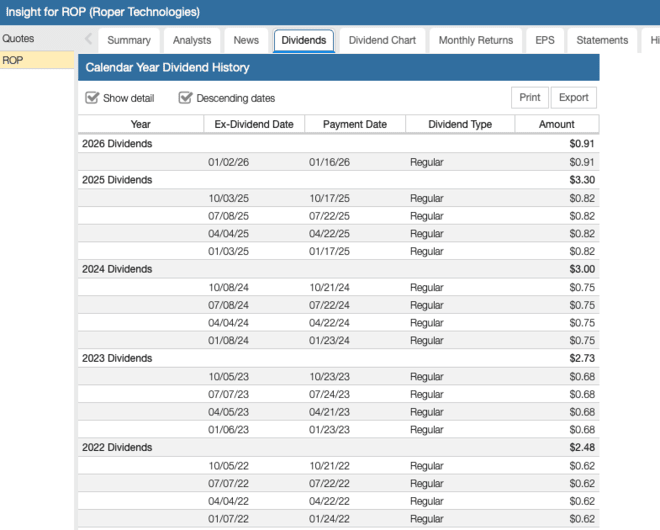

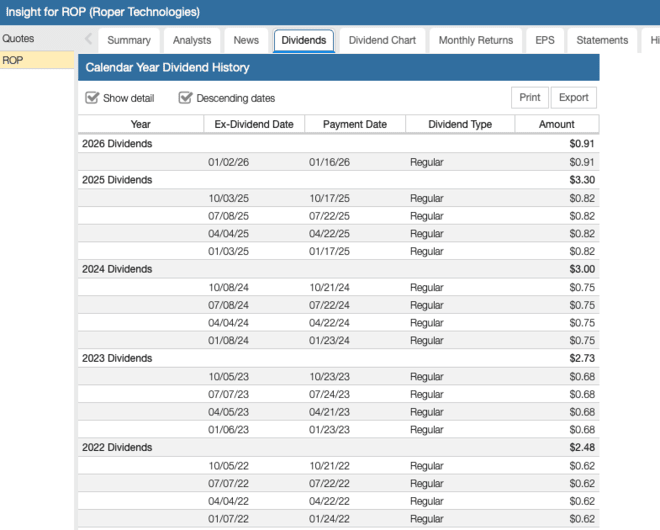

We expect annual returns of 14% for ROP stock going forward. ROP has increased its dividend for 32 consecutive years, making it a Dividend Champion.

PepsiCo Inc. (PEP)

PepsiCo is a global food and beverage company with annual sales of $89 billion. The company’s products include Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice, and Quaker foods.

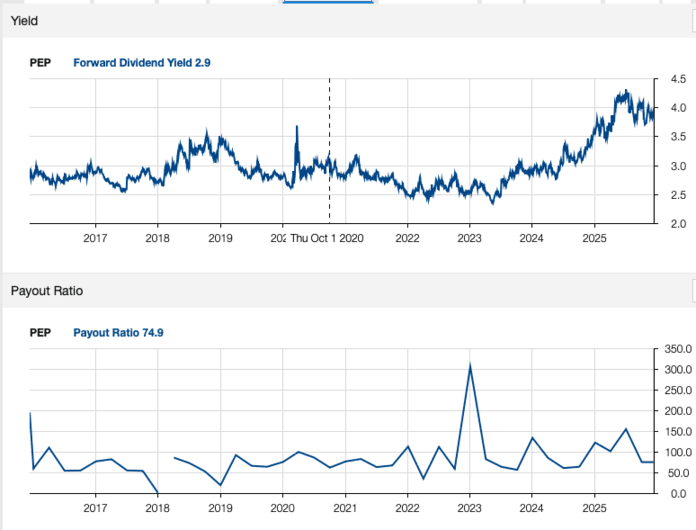

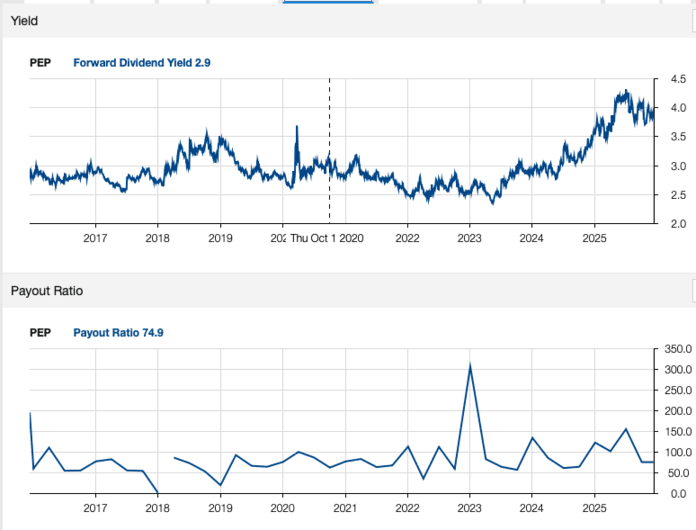

The company has more than 20 brands valued at $1 billion or more in its portfolio. On February 4th, 2025, PepsiCo increased its annualized dividend by 5.0% to $5.69, effective with the June 2025 payment, extending the company’s dividend growth streak to 53 consecutive years. It is on the list of Dividend Kings.

On October 9th, 2025, PepsiCo reported third-quarter earnings results. For the quarter, revenue grew 2.7% to $23.9 billion, which beat estimates by $90 million. Adjusted earnings-per-share of $2.29 compared unfavorably to $2.31 the prior year, but this was $0.03 better than expected.

Organic sales grew 1.3% for the third quarter. For the period, volumes for both beverages and foods were down 1%. PepsiCo Beverages North America’s organic revenue grew 2% during the period, even as volume declined 3%.

We expect annual returns of nearly 15% per year for PEP stock. The company has increased its dividend for 53 consecutive years.

Related Articles About Pepsico on Dividend Power

Brown & Brown (BRO)

Brown & Brown Inc. is a leading insurance brokerage firm that provides risk management solutions to both individuals and businesses, with a focus on property & casualty insurance. Brown & Brown has a notably high level of insider ownership. It is our last stock to buy before Christmas 2025.

Brown & Brown reported third-quarter earnings on October 27th, 2025, and results were better than expected. Adjusted earnings-per-share came to $1.05, which was 12 cents ahead of estimates. Revenue soared 35% year over year, thanks to acquisitions, beating estimates by $70 million to $1.61 billion.

Commissions and fees rose 34% year-over-year, while organic revenue (which excludes acquisitions) rose 3.5%. Income before taxes was $311 million, which was off 2% year-over-year, with margin declining from 26.7% of revenue to 19.4%.

For the nine months, revenue was up 19% year-over-year to $4.3 billion, with commissions and fees up 18%. Organic revenue growth was 4.6%. Income before taxes was $1 billion, up 2%, on margins that fell from 28.4% to 24.4% of revenue. EBITDAC was $1.6 billion on an EBITDAC margin that rose from 35.9% to 37.1% of revenue.

We have slightly boosted our estimate of earnings per share for this year to $4.20. According to Stock Rover*, the company also increased its dividend for the 32nd consecutive year, raising it by 10% to a new payout of 66 cents per share annually.

Disclosure: No positions in any stocks mentioned

Related Articles on Dividend Power

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more. It is an excellent resource for DIY dividend growth investors and retirees.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Bob Ciura

Bob Ciura is President of Content at Sure Dividend. Bob has worked at Sure Dividend since October 2016. He oversees all content for Sure Dividend and its partner sites. Prior to joining Sure Dividend, Bob was an independent equity analyst. Bob received a bachelor’s degree in Finance from DePaul University, and an MBA with a concentration in Investments from the University of Notre Dame.